Why the Payments Industry is Facing Its Biggest Transformation in a Decade

By Yoann Vandendriessche, Chief Product Officer at Intix

The world of payments stands at the brink of a new era. Rapid innovation, evolving consumer preferences and intensifying competition are driving stakeholders across the industry to a point where they must adapt and evolve. In this article, Yoann Vandendriessche, CPO of Intix looks at the factors that have led to these recent shifts and explores how businesses operating across this domain can begin to respond to them.

The payments sector stands at an important crossroad. Over the past decade, payments have evolved steadily, driven by technological advancements, shifting consumer expectations and the rise of innovative business models. However, much of this evolution has been incremental, building upon existing systems rather than fundamentally reshaping them. Now, as we enter 2025, that is beginning to change.

In recent years, we’ve seen payments innovation expand, driving an explosion in transaction volumes around the globe. Yet, despite this rapid expansion, revenue growth has become more uncertain. The increasing adoption of digital payments, real-time processing and embedded finance solutions has intensified competition, placing downward pressure on margins and forcing costly adaptation.

The End of the Era of Easy Growth?

While global payment revenues have historically grown year on year, projections now suggest that this growth will slow in the coming years. According to a recent BCG report, while the volume of global payments will continue to surge, revenue growth is expected to decelerate by 2028. The sector’s compound annual growth rate is forecasted to drop to 5% over the next five years, a notable drop from the 11% figures seen in recent times.

Given these figures, it should come as no surprise that the same BCG report declared the era of ‘easy growth’ officially over. With intensified competition and shrinking profit margins, payment stakeholders must now strive for unprecedented efficiency to maintain competitiveness. This new reality demands a decisive shift away from conventional, business-as-usual approaches towards embracing modern data-driven solutions.

Underlying Causes of Change

I believe four key drivers underpin this transformation, as identified in our recent whitepaper, ‘The Cusp of Change in the Global Payments Landscape’. First, as mentioned, the sheer volume of global transactions continues to surge, outpacing legacy systems and requiring increasingly scalable solutions. Although this trend was already emerging prior to the COVID-19 pandemic, the global crisis significantly accelerated adoption and these new consumer behaviours show every sign of becoming permanent.

Additionally, as transaction volumes have increased, payment transactions themselves have become more and more complex. Interestingly, while the user experience of global payments continues to move towards greater simplicity, the reality behind the scenes tells a different story. No longer operating as standalone processes, payments now encapsulate and reflect the intricacies of the transactions they facilitate.

Speed and Innovation More Important Than Ever

The third contributing factor is that payments are now occurring not only at significantly higher volumes and greater complexity, but also at speeds previously thought unimaginable. In just a few years, the standard for payment processing has shifted dramatically, from days to minutes, and now, to mere seconds. For stakeholders, this quick evolution demands continuous innovation and strategic agility to remain competitive and relevant.

For context, real-time payment (RTP) infrastructures are now operational in over 100 countries, with RTP transaction volumes projected to exceed 575 billion by 2028, accounting for 27% of global electronic payments. Research from McKinsey further corroborates these figures, suggesting that instant payments are displacing traditional cash and card transactions and could eventually account for over 30% of global payment volumes

The fourth driver is that as the payments landscape evolves, so do the methods that end-users rely on for their daily transactions, adding yet another layer of complexity for stakeholders. Businesses today must stay attuned to innovative solutions emerging across the market, particularly the sudden rise of alternative payment methods in countries such as India, China and Brazil – developments that simply cannot be overlooked.

Solving for the Shift

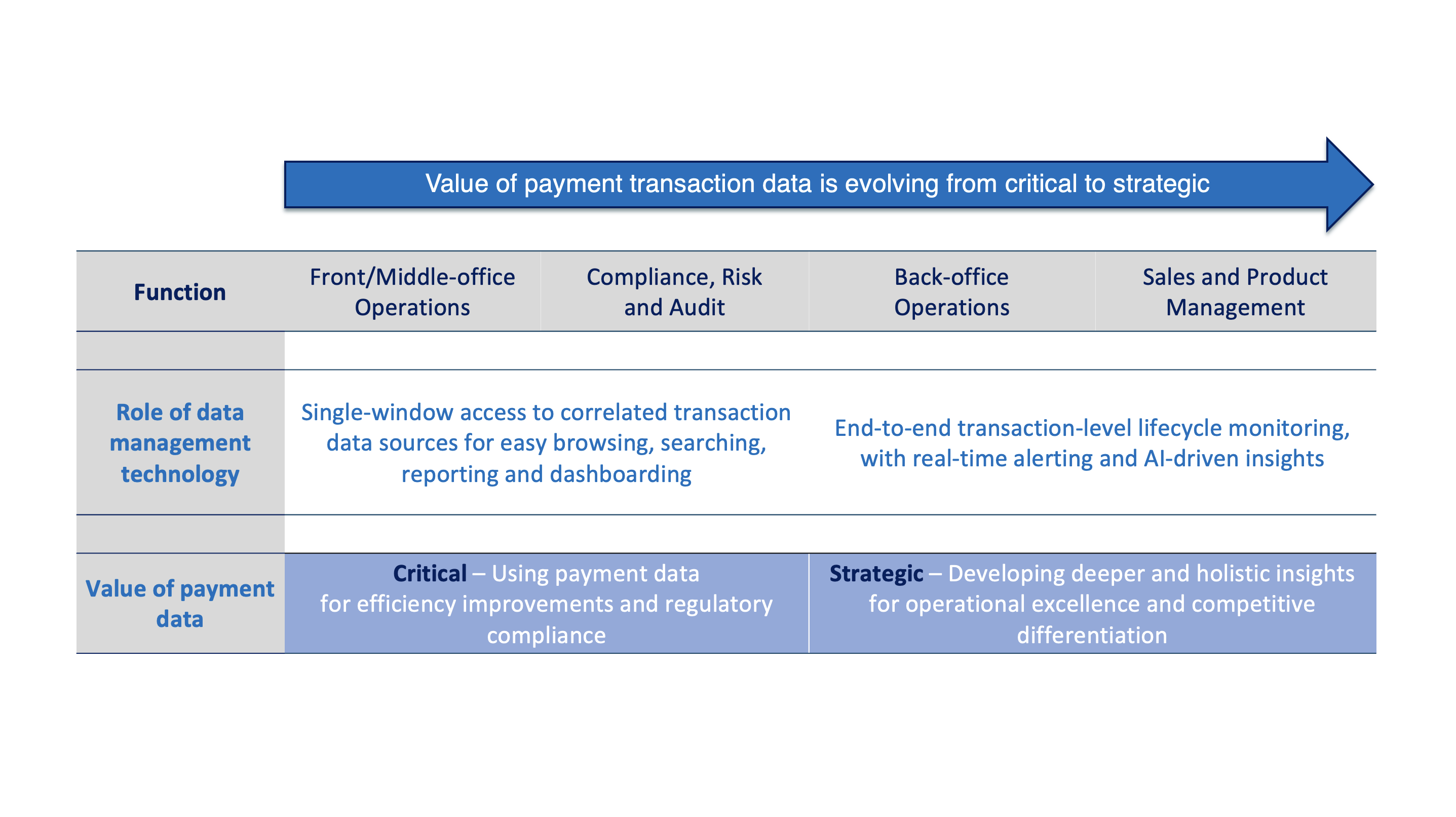

In light of these four shifts, the payments sector stands on the brink of transformative change, assured to disrupt traditional norms and established practices. While these developments certainly present challenges, they also offer significant opportunities for those ready to adapt. Central to this opportunity is data. In this new period, the ability to instantly access, analyse and act upon transaction data is no longer just advantageous, it’s essential.

Moving forward, data-driven strategies will be necessary for businesses aiming to optimise operations, strengthen compliance and meet ever-evolving customer expectations. To stay competitive, payment providers must adopt scalable and resilient infrastructure and harness the power of advanced analytics. Importantly, they must also prioritise systems that foster transparency, ensuring seamless end-to-end visibility of transactions.

Ultimately, success in this new generation will not be defined by simply keeping up with change but by leading it. By harnessing data effectively, businesses can drive innovation, improve efficiency and unlock new avenues for growth. The path forward is clear – those who invest in the right tools, technologies and strategies will be ready to thrive in the future of payments. Let’s hope the sector embraces this moment for change.