Why transparency is vital to finding success in Open Banking

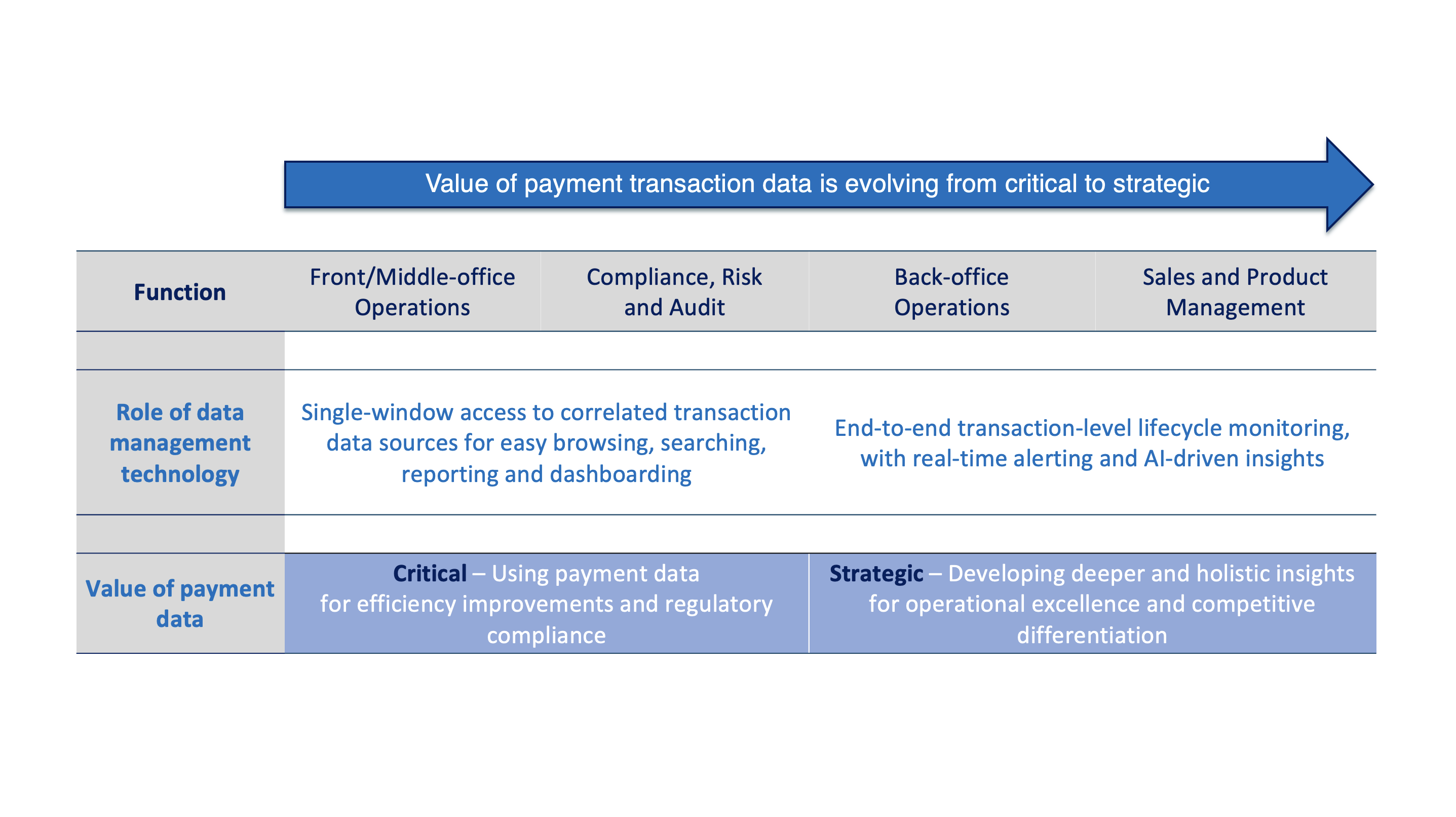

Businesses must recognize the importance of responding to the updates to PSD3 by implementing data management solutions that can provide comprehensive insights on transactions. By prioritizing systems that collect, correlate, analyze, model, and report data sets, businesses can ensure compliance and support compliance professionals in the event of investigations. This will not only ramp up transparency and boost fraud detection but also facilitate financial management and regulatory compliance. Additionally, these solutions provide opportunities for more personalized experiences, enhancing customer satisfaction. To stay ahead in this ever-evolving landscape, businesses should engage further with the article published in “Retail Banker International” on August 15th, 2023, to gain a deeper understanding of the strategies and technologies required to navigate the changes brought about by PSD3.

Discover the news article published in “Retail Banker International” on August 15th, 2023.