ISO 20022 finally becomes reality – what now?

Despite some delays, not at least because of the Covid-19 pandemic, the migration to ISO 20022 is now fully underway and financial institutions are looking forward benefitting from their investment into the new standard.

The implementation of ISO20022 message standards is the most impactful event in payments for decades and comes with significant changes on how financial institutions process their payments.

SWIFT is currently estimating that by 2025, 80% of the RTGS volumes will be ISO 20022 based with all reserve currencies either live or having declared a live date. Financial institutions need to carefully assess on how they can transition from minimal compliance to full adaptation to the new standard in the next years. Varying deadlines and coexistence periods will require banks to be strategic in their migration approach.

Like many significant changes, this does not come without challenges, especially as there will be a transition phase during which past and current message standards will be used. Most institutions have put their focus on changing their system infrastructure to process both standards during this phase but there is still a long way to fully utilize the capabilities of the new standard as well as to handle add-on functionality like archiving or analytics on past and new transactions.

Typical challenges are as follows:

- Handling both standards during the transition phase

While early adopters are ready to send and receive ISO 20022 messages, there is a transition phase during which other institutions will not yet be able to fully handle the new messages. This has several implications among the fact that even if bank ́s preference is to stay on the legacy MT formats, they will by default receive ISO 20022 messages with embedded translation, which they will then have to be able to process. This entails the ability to archive the full information and perform Anti-Financial Crime (AFC) due diligence on the ISO 20022 messages.

- Finding a rational balance in implementing multiple critical projects

The complexity and the expense of this migration are both daunting, but minimal compliance will likely mean missed opportunities. It is critical that banks focus on future-proof strategies rather than the immediate business case. Elaborate the best migration approach for parallel programs, and consider the potential synergy of aligning several migration programs (e.g., SWIFT and T2) where applicable.

- Risk of information loss with legacy MT formats

Whilst SWIFT began this transition in November 2022, in line with the ISO 2022 migration of the European Market Infrastructures supporting the euro, not all market Infrastructures will be ready to support the data rich ISO 20022 messaging standard at this time. A simultaneous migration of multiple market infrastructures on the same day creates too much risk and hence the migration will take place over several years, creating data integrity challenges during the migration period.

- Storage of increased volumes and size

ISO 20022 messages are significantly larger in size compared to SWIFT MTs (for global payments), CHIPS and FEDWIRE (US payments), and other payment message formats. Sometimes up to a hundred times. Financial institutions will need to develop new archiving concepts and resize all current infrastructure to consider the storage requirements of financial messages.

This also includes new ways for searching, retrieving, analysing and reporting historic message data in the context of compliance and legal archiving.

ISO 20022 messages are large in size compared to SWIFT MTs (for global payments), CHIPS and FEDWIRE (US payments), and other payment message formats. Financial institutions will need to resize all current infrastructure to consider the storage of financial messages. This would increase their interest in IaaS (Infrastructure as a service), which offers essential compute, storage, and networking resources on-demand.

- Analytical information on past and new transactions

Many banks today offer customers a real-time payments dashboard. The potential of ISO 20022 here is to radically expand both the accuracy and quantity of the information these dashboards display.

To be able to utilise the newly collected data as well as being able to provide past transaction information, fast accessible data repositories need to be implemented which can hold old and new ISO standards along with API’s to consume the data for real time customer reporting.

- Financial crime and fraud prevention

Standardized messages will help improve fraud prevention capabilities and regulatory reporting activities. Rich remittance information like purpose code and LEI in ISO 20022 payment instructions is meant to provide banks with more detail and context of a transaction. It provides visibility where a payment is going and why it’s being instructed. Structured name and address details for both sender and beneficiary can help to improve AML and sanction screening. New AML systems can train their AI functions to produce more accurate results which consequently results in less false positives. Historic data in archives will also need to consider the additional data elements when responding to regulator requests. The enhanced complexity of ISO 20022 messages will require new methods to scan and analyse the underlying transactions and their context.

How can data management specialist – Intix – help to master the transition period?

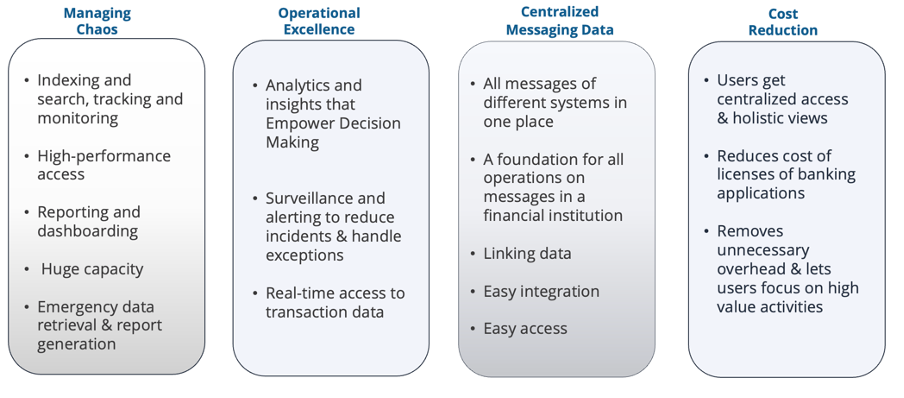

Intix provides a complete legal archiving solution for financial messaging which is accessible in real time. This provides access to a single source of the truth on the real-time and historical SWIFT data across ISO 20022, ISO 15022 and MT messages. Indexing technology allows extremely fast, configurable, and rich searching through the financial messaging data. A single message or list of messages can be retrieved in mere seconds.

The solution is non-intrusive, meaning that it is not deployed in between the existing message or transaction flow(s) of customers. It acts as a full data layer of your SWIFT archive and is easily deployable to all the users. Users can create their own reports and exports with the integrated reporting module. Customer can choose from a variety of different visualisations to get a full insight into the message data. The data can also be accessed by pre-built API’s to integrate with existing applications, e.g. a customer portal.

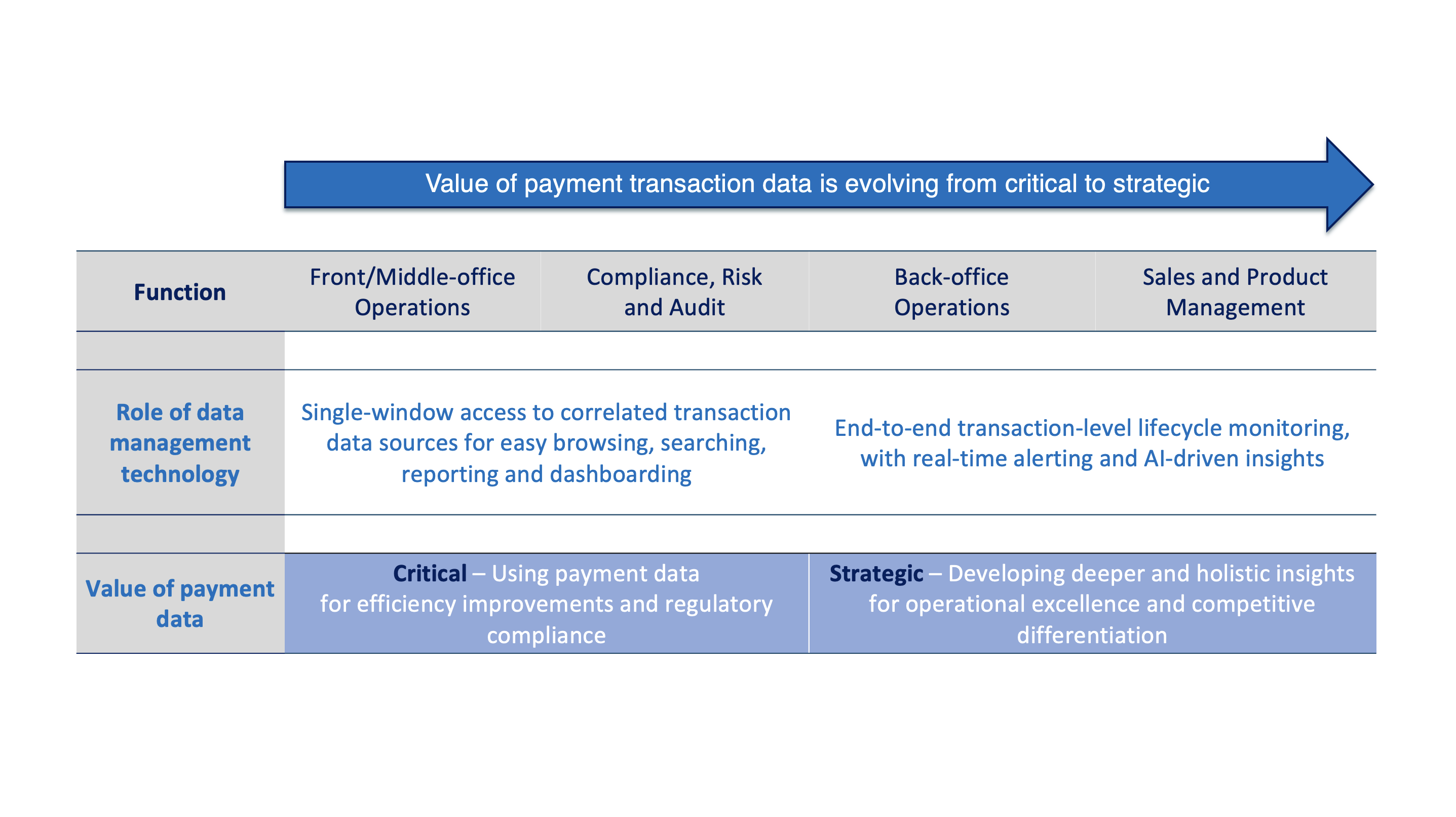

Intix offers peace of mind to financial institutions and market infrastructures and help address a set of operational challenges related to the migration to ISO 20022 as depicted below:

More information

Discover how Intix can help you benefit from advanced data management technologies.