Payment technologies are evolving fast but it’s the payments data that makes the difference

The evolution of cross-border payments is more exciting than ever. However, for banks, the priority is to use the payment data for operational excellence, compliance and competitive differentiation. So, get your data in order.

This article was initially published in Trade Finance Global.

Continued innovations in cross-border payments

Cross-border payments have transformed over the last six years like never before.

Around a decade ago, new entrants prompted SWIFT to find a way to increase visibility by tracking global payments processed by correspondent banks. And so, SWIFTgpi was born.

More recently, the growing adoption of – and a concerted industry migration to – ISO 20022 in the cross-border and high-value payments space promises to be valuable. This new norm improves data structures and caters for richer business content to be embedded in payment instructions and statements.

It is a long overdue move, as ISO 20022 launched two decades ago. It also presents some operational challenges to banks given the number of legacy formats and systems in place.

SWIFTgpi and ISO 20022 provide much-needed incremental improvements to the traditional cross-border payments space but aren’t moving the needle far enough.

Thankfully, transformational technologies have emerged and are being adopted.

Those have been built on borderless 21st-century foundations and enable payments to be seamlessly embedded into commercial transactions, thereby reducing settlement risk.

New technologies such as distributed ledgers offer a way to bring such improvements to person-to-person remittances, micro-payments, and small- and medium-sized enterprises (SMEs) payments.

Various payment and securities processes are already moving on-chain to remove frictions, increase transparency on end-to-end transactions, and combat fraud (e.g., public blockchains).

Moving on-chain facilitates Delivery versus Payment (DvP) settlement of tokenised assets, whilst increasing transparency and immutability of data. The openness of policymakers (e.g., UK, EU, UAE) to digital assets and tokenisation will definitively act as a catalyst in institutional segments.

Hint #1: There is no escape to tokenisation and digital assets.

It’s the natural evolution of the Internet [of Information]

to become the Internet of Value.

Increased complexity for transaction banks

Incremental and transformational innovations demonstrate the continued appetite for the industry to achieve cheaper, faster, more transparent, and more accessible cross-border payments.

These industry-wide advancements show drive to deliver on the vision outlined by the Financial Stability Board (FSB) in its G20 cross-border payments roadmap.

Whilst such moves offer attractive options to end-customers, they also drastically increase the complexity for banks’ IT, operations and compliance teams. This is the natural fall out of new channels, systems, and data structures being introduced within their technology infrastructures.

Stephen Wojciechowicz, senior principal, product management at BNY Mellon, recently confirmed this, saying, “The challenge [with ISO 20022] is going to be that the underlying source data applications need to be able to communicate that. For example, in our static data for address, there isn’t a separate data field for the street. So, we will have to be able to change things to accommodate that structured data format.”

Hint #2: Payment standardisation will be centred around ISO 20022 and those semantics will be supported by a mix of proprietary and open communications technologies.

Getting your data in order more important than ever

Long considered a purely technical function, archiving transaction data was previously only a concern for the bank IT people to take care of. That was about 15 years ago. The need to access data archives was fairly limited and mostly linked to ad-hoc operational needs and client requests.

Since the 2008 global financial crisis, however, regulatory requirements revealed the importance of this very function, as accessing transaction archives suddenly got on the compliance officers’ priority list.

Subsequently, being able to demonstrate record keeping of transactions and to report promptly on payments – whether archived or in production – became top priorities.

Access to payment data is also important – in an automated way – for front-office operations teams (e.g., offering online access to transaction details for clients via portals) and for back-office operations teams (e.g., to get real-time alerts on failed transactions).

Furthermore, business and compliance functions are combining payment data with AI-driven algorithms to gain deep and contextual insights never achieved before.

While having a single central database of all payment transaction data would be ideal for making it accessible, experience has shown that this is not realistic for financial institutions. This incompatibility stems from the many disparate data sources, geographic locations, specialised internal systems and channels in use.

However, applying data management technologies to link, correlate, track, report, and alert on end-to-end flows helps financial institutions tackle the data accessibility challenge.

Hint #3: Get your payment data in order. Data management technologies make it easy whichever number of in-house legacy systems.

Payment data to comply and to differentiate

Compliance and competition remain the two imperative objectives for financial institutions.

Whether the one or the other payment innovation becomes relevant for your financial institution, the granular data derived from payment flows is the actual ingredient to make it happen.

Hint #4: Whilst new payment rails gain traction, investing in data technologies is the safest and most impactful decision for financial institutions.

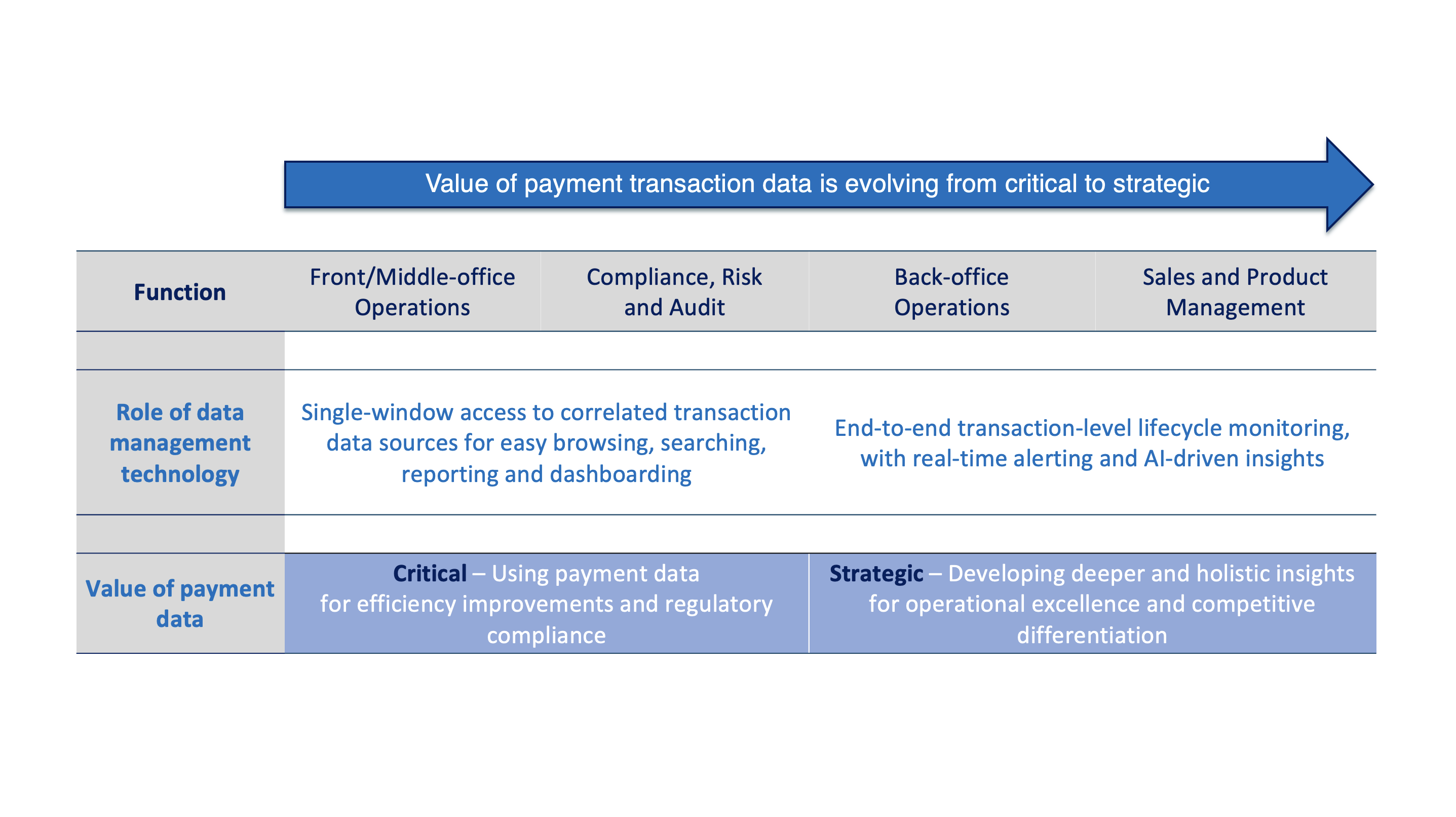

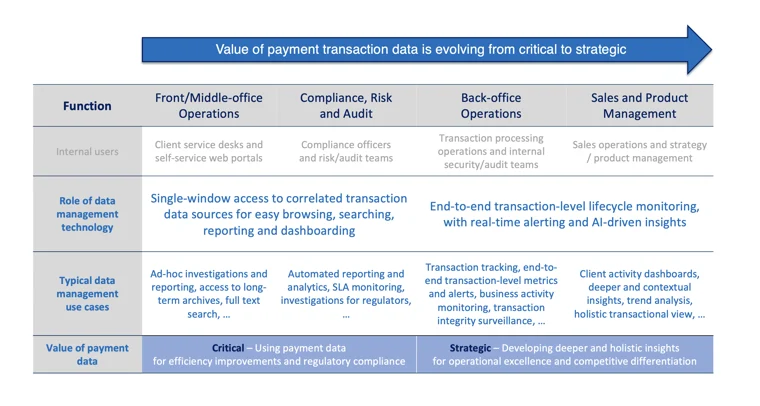

The following table highlights the typical use cases where payment data is both critical for operations and compliance, and strategic for competitive differentiation.

Leveraging data for competitive advantage requires a significant data management overhaul.

That includes identifying and assessing the value of existing data, designing a scalable data platform, and developing a long-term data strategy to help the organisation achieve impact at scale.

It also requires up-front investment in data management technologies, as well as skilled teams.

Data technologies fill the gap

Keeping up with the pace of innovation in cross-border payments can be a challenge for most transaction banks, given the number of available new options and evolving client expectations.

Going forward, those financial institutions with the best data systems will develop a competitive advantage given the effectiveness of transaction data in helping along compliance and increased commercial differentiation.

More information

Discover how Intix can help you benefit from advanced data management technologies.