Payment tracking is essential – for instant payments too

As transaction banking is witnessing a flurry of digital innovations, one major value proposition stands out: transaction visibility and control through end-to-end tracking. But what does end-to-end mean to provide meaningful insights and full visibility? Can one single provider deliver a complete solution? What are the required technology components to track transactions from start to finish?

Doing business requires the continuous exchange of information, of money as well as timely delivery of goods and services. The Internet made information fly in real time, flawlessly and at global level. Money, however, has not reached that level of speed and convenience as it still takes multiple days to credit cross-border beneficiaries on most international routes, even within the EU such as from the UK to Belgium. In a world moving to real-time experiences and the Internet of Things (IoT), this isn’t sustainable. Change is inevitable and change is happening.

Major efforts can be witnessed since a few years across the banking industry to remedy this situation. All players ranging from transaction banks, incumbent infrastructure providers and new entrants recognise the need to drastically improve long-standing practices in global payments and global trade. The heat is on.

Cross-border payments get on the SWIFT gpi Tracker

In the cross-border payments market, various propositions have emerged to increase speed and enhance convenience for end-customers. Most of those require working with fintech intermediaries focusing on specific corridors and client segments, thus lacking a global proposition. They succeed to attract niches of clients but fail to address global needs consistently.

One well-known player is best positioned to address new needs in the global payments landscape: SWIFT.

SWIFT’s global payments innovation (gpi) is the foremost example of an incumbent infrastructure reacting to emerging needs, and preparing itself for future battles with new entrants in the non-card space. Transaction workflow management is not part of SWIFT’s initial design as the early mission of SWIFT was to automate the telex. Payment message tracking has therefore been introduced as an added value layer which is what SWIFTgpi brings to the industry. By monitoring and tracking cross-border payment-related messaging flows, SWIFTgpi succeeds to increase end-to-end transaction visibility. It upgrades the inter-bank payments practices, thereby helping banks offer an enhanced experience to their corporate and SME clients. Such innovation is a no-risk all-gain move for transaction banks.

Cross-border payments may get on the blockchain

Next to SWIFT’s efforts, a series of entrants are betting on the promise of the blockchain. Those need however more time to prove themselves even if short-term progress is palpable as demonstrated by central banks interest on CBDCs. By relying on the distributed ledger technology (DLT) as underlying value transfer mechanism, payment processing embeds tracking and auditing natively. Whereas swiftGPI suggests an incremental upgrade of telex-style correspondent banking practices, the new DLT-based payment solutions might be transformative but only in the coming 3-5 years.

One more imperative … tracking internal transaction processing

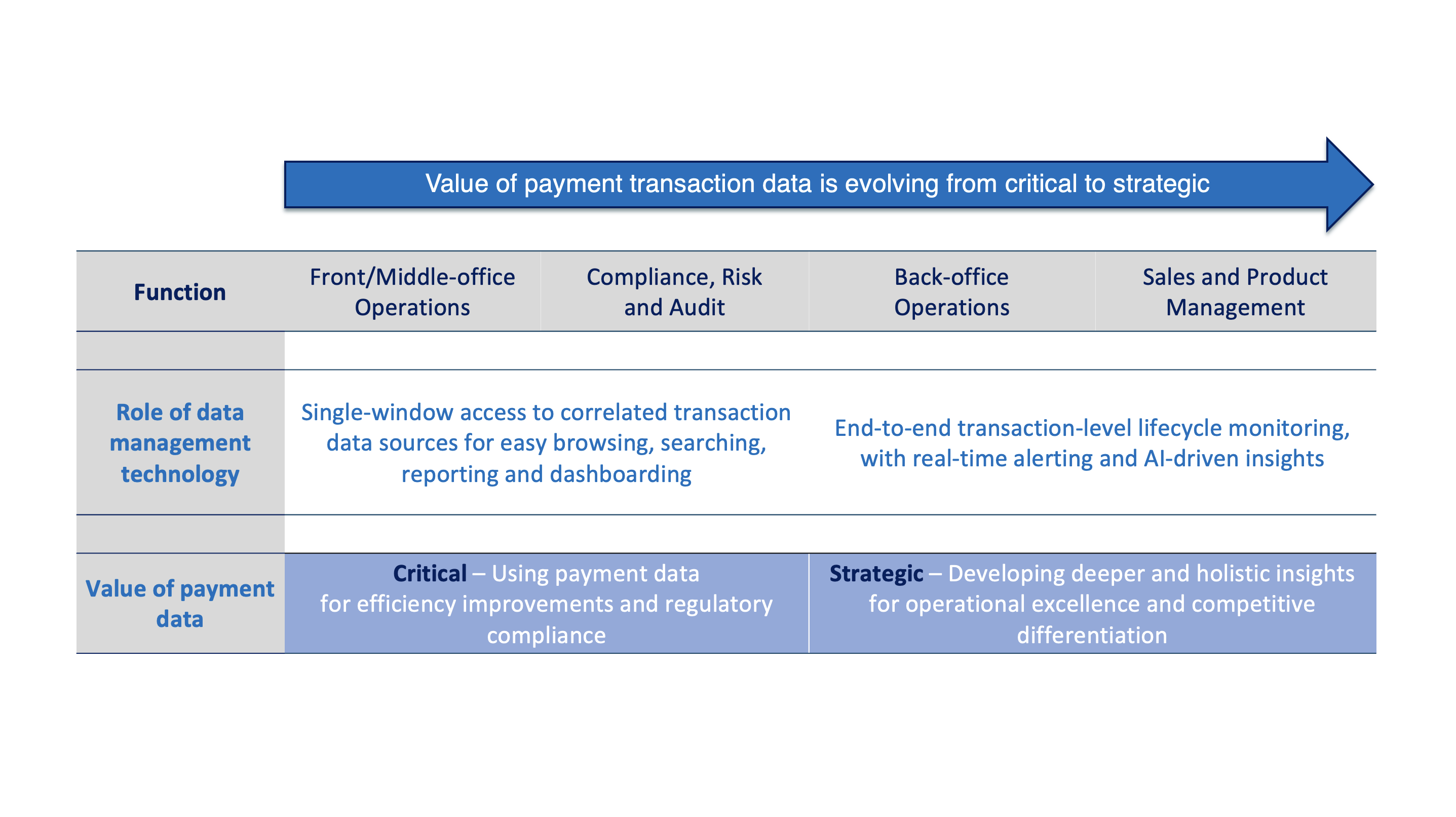

When processing payments through traditional and/or more recent technologies, one capability is often underestimated: your ability to track transactions internally, i.e., within your own IT infrastructure. As most of the transaction details reside in various internal systems, a dedicated enterprise-wide transaction tracking layer is best suited to implement end-to-end tracking.

This is where Intix can help you

Intix delivers enterprise-wide business activity monitoring integrating both internal and external transaction data feeds. It caters for high-performance tracking of high-volume transactions in real time by plugging seamlessly to banks’ internal systems. Intix will increase your visibility and control on your payment operations whether those are taking days or just a second to clear.

A safe bet

Offering increased payment transaction visibility to your clients is a safe bet. Whether you handle payments through correspondent banking or instantly through a blockchain provider, clients now expect their banking partners to offer full visibility a well as analytics. Various industry innovations are elevating client expectations and succeeding to prove their value. This is why investing in enhanced internal transaction visibility and control is key to keep up with market trends. Intix makes it happen and has made it happen.