Future Banking: Corporate Banking and Transaction Services in an Era of Innovation

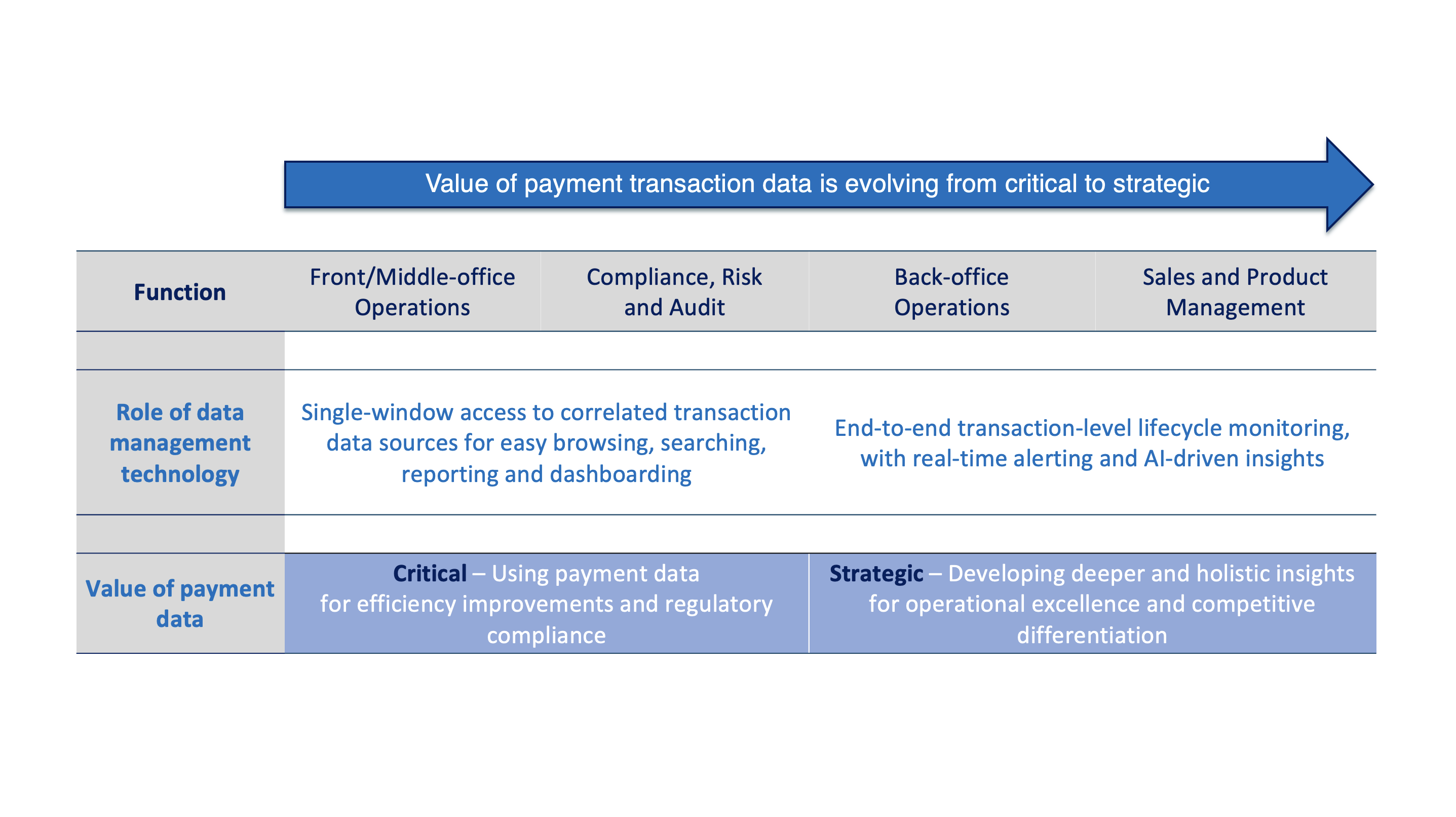

Corporates have long been banking’s most profitable customers, with most banks revving up services for corporate customers. Greater innovation in data management can help banks better service their corporate customers, increase revenues and deal with the challenges of mounting regulation.

In this video, we look at innovation in corporate banking. HSBC’s Global Head of Innovation (Global Functions) Steve Suarez, in London, discusses strategies which the bank is adopting to enhance services for corporate customers including developing more personalised customer experiences and reducing timespans for cross-border trade in many cases from 10 days to 24 hours, and talks broadly about mitigating risk to keep customers safe.

Later, in Belgium, Antoine Cuypers, Director EMEA, at transaction data management experts Intix, discusses how greater visibility across payment transaction lifecycles offers the promise of “Know-Your-Transaction” to create greater efficiencies in cross-border payments, enabling banks to serve corporate customers even better.

Discover both interviews by Christopher Watts, Co-Publisher, Future Banking: