The role of transaction data in payments operations

Fintech Finance talked to Sajid Gani, Head of CIB Operations South Africa, Standard Bank, about the evolution of the payments landscape and the use of Intix to make transaction data accessible and actionable.

Here are Sajid Gani’s key messages:

- We are witnessing an extraordinary change at exponential level given the pace of digitisation. Payments are becoming instant and almost free. There lies the challenge for traditional banks

- Various providers and new entrants are offering such low-cost instant payments at cross-border level. The heat is on for traditional banks which is why they need to move on from legacy thinking

- The customer experience is of vital experience. Digitisation is only part of the solution but the way to achieve it and bring it to clients is crucial

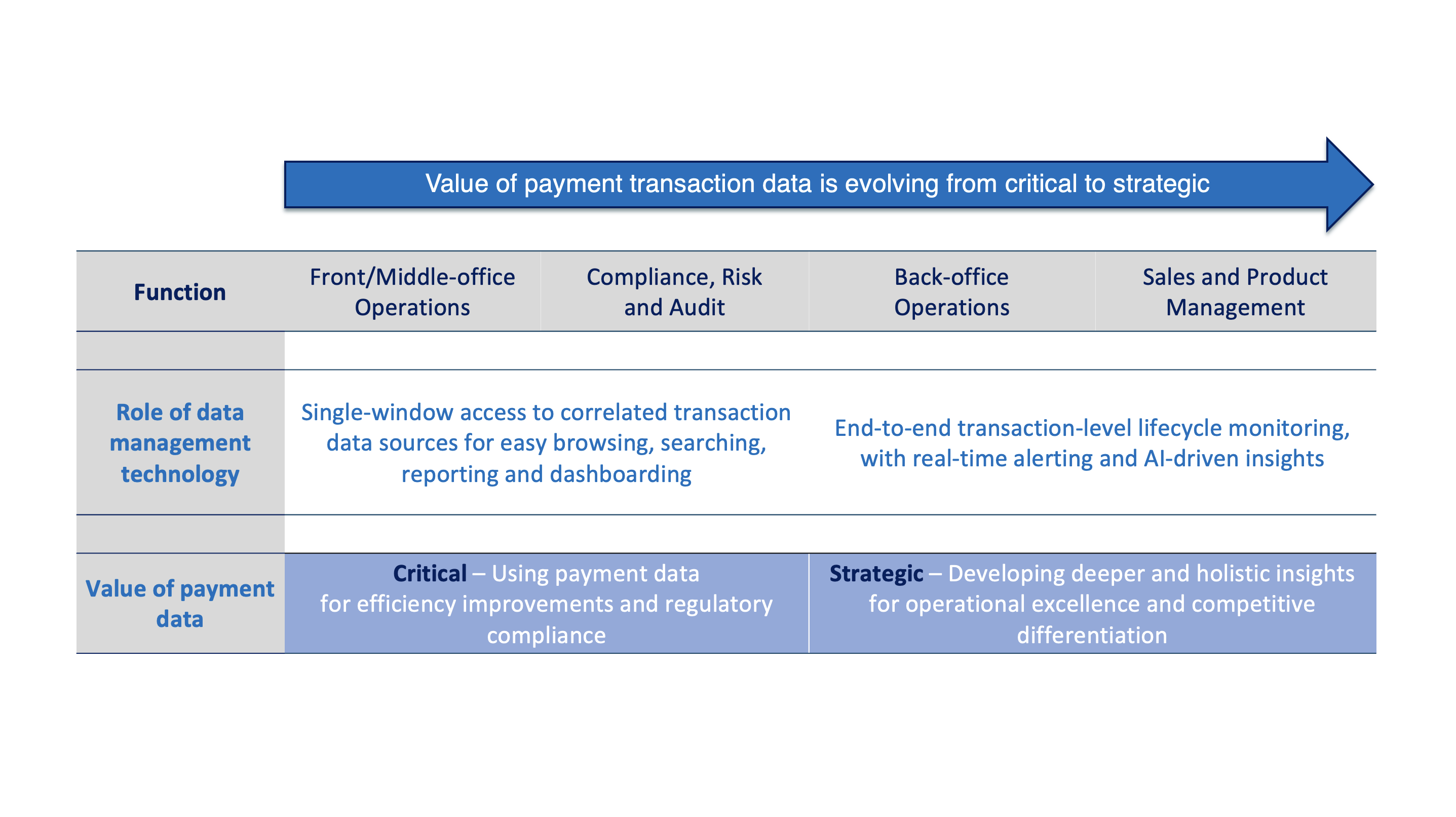

- Intix helps us understand the value at risk – we need the ability to understand at any time what the value at risk is across our internal payment value chain. Certain banks have this ability to quickly gain insights to resolve consequences of outages. This is a major competitive advantage

- We also use Intix in conjunction with additional tools such as SWIFTgpi to extend the transparency to our clients

- The relationship with Intix is one of win-win. The insights we gain from Intix help us interpret the data to make strategic decisions. The data always tells a story but you have to look for the story.