Monitoring payments in real time across the end-to-end processing

Fintech Finance talked to Erik Zingmark, Head of Transaction Banking, Nordea about the importance of business activity monitoring to benefit from end-to-end payment transparency.

Here are Erik Zingmark‘s key messages:

- We have accelerated the journey towards a cashless society, through Covid. People are using mobile wallets more and more, and e-commerce is exploding in the Nordics

- The whole challenge with the move to a cashless society is the tail of people entering the banking system and who don’t have immediate access to those payment services. Banks will find a solution to this issue

- Balancing the relevance of innovations and the compliance restrictions is both a key challenge and a priority for banks

- Artificial Intelligence will make banks far more efficient to fight financial crime and to comply with regulations

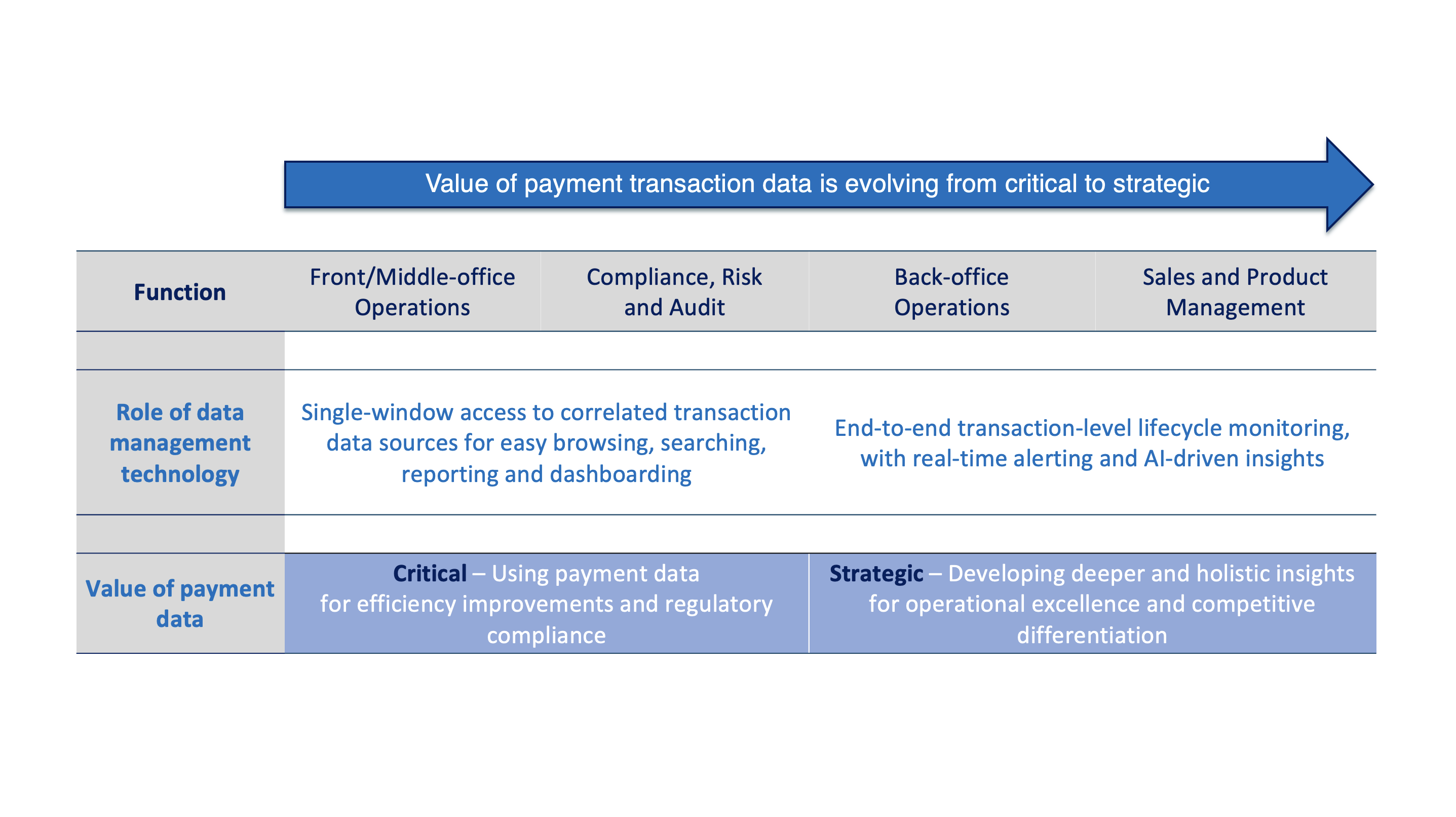

- Collecting the data is a pre-requisite as it is a key enabler for incumbent financial institutions to leverage data they own and process. For banks, the challenge is about collecting the data which is a complex task given the hundreds of internal systems processing and storing that data. The web of critical systems is very complicated, and a banks we need to prepare ourselves to be able to collect the right data, before we think about using it

- Payments is a scale business, so banks need to attract high volumes. It is important to sunset legacy systems and introduce new technologies. Standards are critical as well because they benefit all stakeholders

- At Nordea, we are engaging in that phase to be able to leverage payment data in future processes. We are also engaging with infrastructure providers such as SWIFT and P27

- Customers are asking themselves: how comes the bank doesn’t know where the payment is. Why is it that banks have incidents and they realise this so late, and can’t address client payment-related queries

- Nordea strives to come to a point where we will be able to monitor in real time where the payment is both within Nordea and outside Nordea. This is the goal of the business activity monitoring (BAM) project which brings that real-time information to our customers. BAM will help us also manage incidents more proactively. That is the next objective

- Intix is used for this purpose internally and its use will extend to P27 which is a strategic multi-bank initiative in the Nordics. Our 2nd line of operations will be using Intix as well as during the MT-MX Migration period, as part of message archiving function.

- Intix brings us end-to-end transparency which is a must these days to serve clients.