Intix and SWIFTgpi offer the best of both worlds

xTRACE will become your best ally to operationally monitor your cross-border payment operations from start to finish. When combined with SWIFTgpi, xTRACE will further extend visibility on actual processing down the chain by correspondent banks.

SWIFT global payments innovation (SWIFTgpi) aims at improving the customer experience in cross-border payments by increasing the speed, transparency and tracking of cross-border payments across the correspondent banking chain.

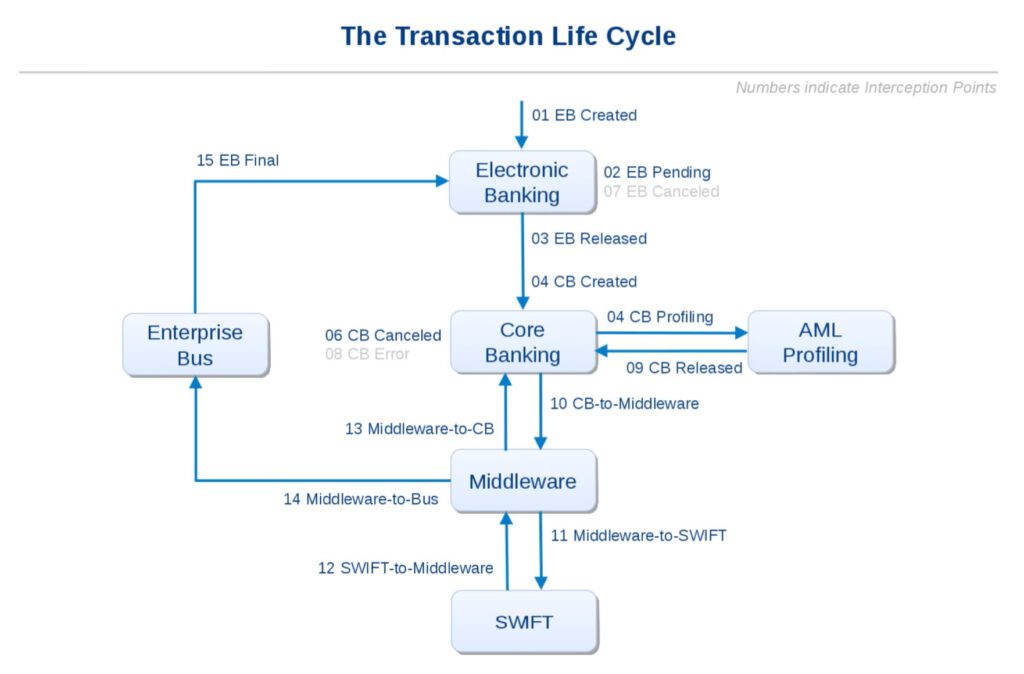

All banks – whether large or smaller – rely on a complex set of internal systems supporting the end-to-end processing of cross-border payments, ranging from e-banking portals and channels, to connectivity software, sanctions filtering systems, messaging middleware solutions, core payment engines, interfaces to clearing systems and correspondent banks, … As a consequence, payments initiated by their clients often go through a dozen of (or more) processing systems and steps before reaching completion with certainty of credit on the beneficiary’s account as illustrated in figure 1.

Figure 1. Sample internal cross-border payment processing workflow at a bank.

Unfortunately, operational system glitches do occur and represent potentially severe consequences on business-to-business payments and supply chain counterparties who depend on the timely delivery of those funds. For both banks and their clients, costs of failed payments can be huge as are reputational risks. This is why banks have come to realise that monitoring payment operations ought to be achieved in a much more thorough way and at a more granular level.

Whilst some would suggest that rationalising the number of internal / legacy systems and technologies would help address such challenges, reality has demonstrated that a “total infrastructure revamp” would be very costly and close to unworkable as business priorities and market innovations (e.g., instant payments) just keep on extending the internal technology mix. On the contrary, one must take advantage of well-functioning legacy systems and build on those using the most appropriate modern technologies. In this way, transaction tracking and efficiency analytics can be easily delivered by specialised technologies.

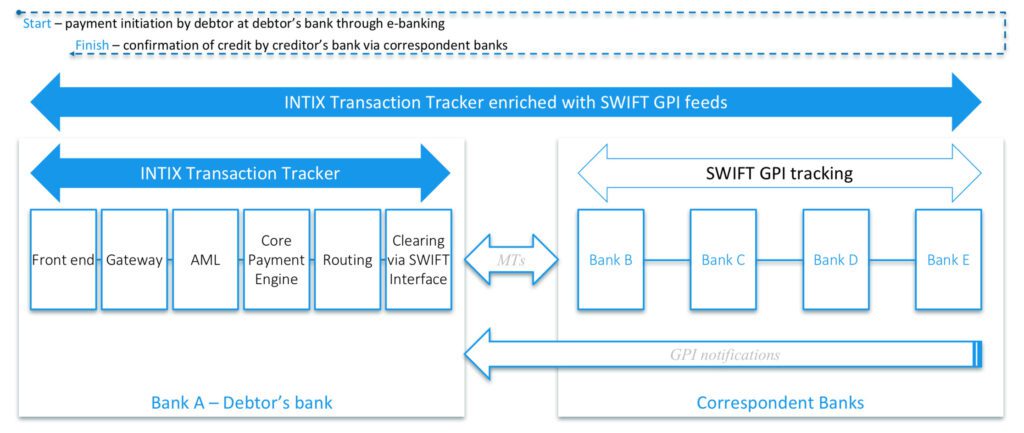

Whilst SWIFTgpi provides the ultimate way to enhance transparency on payment processing by correspondent banks, xTRACE maximises granular visibility on internal payment processing steps and performance.

xTRACE provides transaction bankers with:

- Multi-system transaction tracking across technologies, transaction types, data semantics, messaging formats, communication channels, …

- Enhanced tracking using external feeds such as SWIFTgpi

- Comprehensive tracking dashboards across single, batch, instant payments and other types of transactions (fx, trade finance, securities, …)

- Effectiveness and efficiency metrics and dashboards

- Alerting and decision making based on user-defined rules and cut-off times.

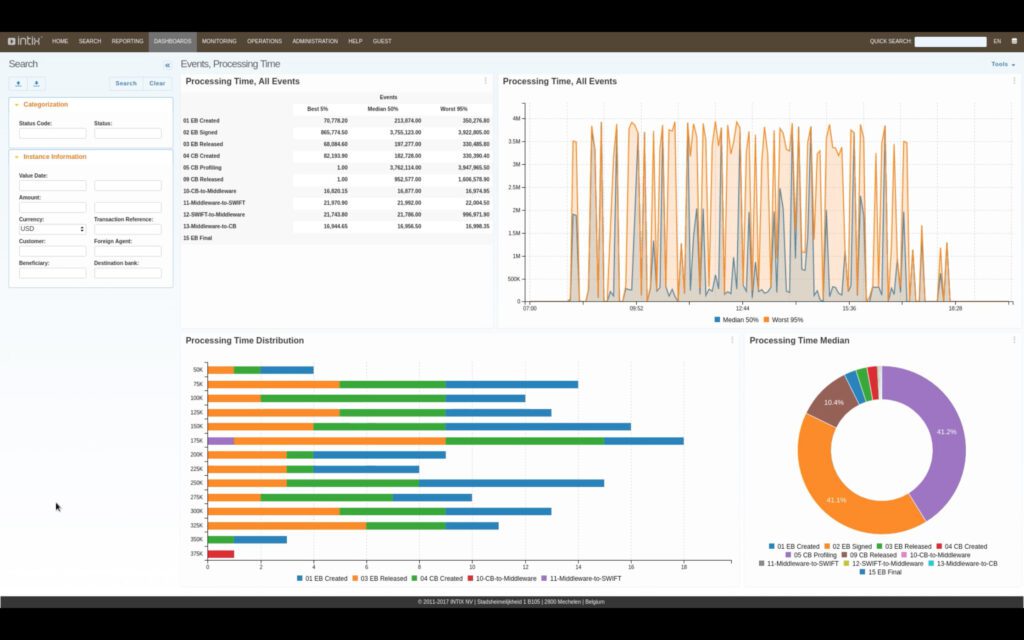

The more interception points a bank integrates into xTRACE, the higher the process transparency and the lower the operational risks. Figure 2 provides an example of such performance dashboard including distribution in terms of processing times across interception points.

Figure 2. Processing time metrics for a single currency (e.g., USD)

The best of both worlds: SWIFTgpi enriches xTRACE

Whilst xTRACE combines the many statuses collected at various interception points within the bank’s own processing infrastructure, its value will be maximised when external tracking feeds are added. Enriching xTRACE with SWIFTgpi notifications as delivered by correspondent banks will maximise value for banks and their clients, whether acting on the debtor side or creditor side. This combined use of Intix and SWIFTgpi is depicted on Figure 3 from the debtor’s bank point of view.

Figure 3. SWIFTgpi enriches internal payment monitoring performed by xTRACE.

The combination of both sources of monitoring information provides payments operations teams with the best of both worlds.

“Whilst SWIFTgpi increases tracking within the inter-bank correspondent banking space, its value is geared towards corporates trading at international level. Banks will favor delivering their own DHL-like payment tracking dashboards to their clients. This is what INTIX will help them achieve, in the smoothest way”

Conclusion

xTRACE will become your best ally to handle your daily payment operations. It will help you get full transparency on payments being processed as well as other types of transactions.

Thanks to advanced data management features incorporating SWIFTgpi, Intix helps banks maximise the end-to-end visibility on cross-border payment processing, prevent operational issues and avoid negative impact on their clients.