How to address the ‘digital readiness’ challenge in trade finance

Never has trade been a greater focus of global attention. Never has trade finance been a greater magnet of digital innovations.

Advanced technologies such as machine learning were recently launched on the market to help financial institutions better serve their clients and attract new funders. One theme, however, resonates frequently: banks’ internal systems are hard to capture transaction information from, and such data is needed to feed both human operations as well as value-added trade finance processes. How can banks address both objectives, i.e., (1) to protect legacy internal systems from any costly impact whilst (2) applying new technologies in the area of trade origination and distribution?

In late 2018, Intix assessed this “Digital Readiness” challenge and identified value for its clients to combine its “data management” capability with a set of trade finance “fintech” providers that apply machine learning in specific trade-related use cases.

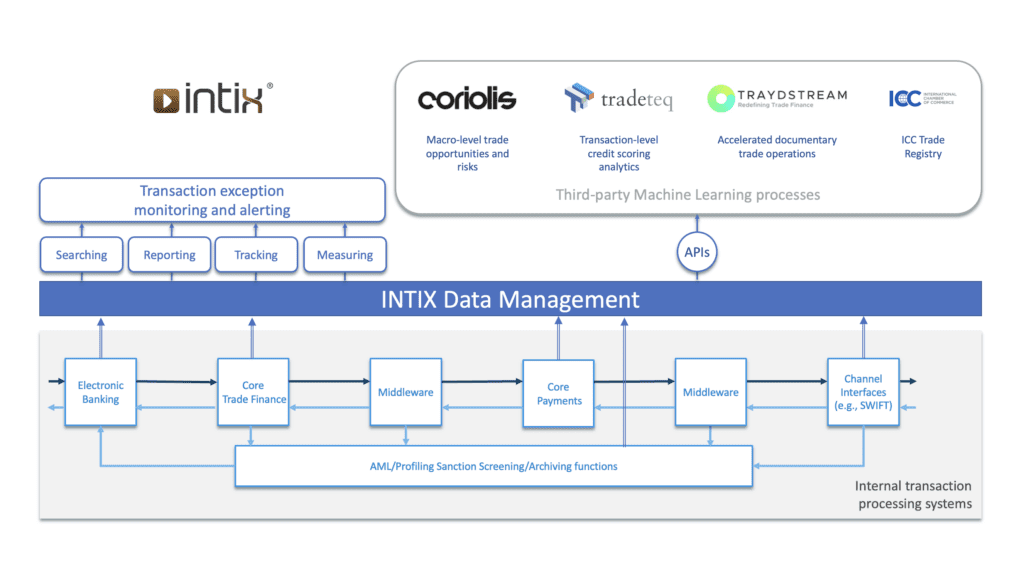

The below identifies the options. Whilst Intix helps financial institutions increase data accessibility for searching, reporting, tracking, … the data management technology offered by Intix also enables financial institutions to become digitally ready when embracing fintech propositions. This is particularly important when implementing machine learning processes dedicated to trade finance. Examples include Coriolis Technologies, Tradeteq and Traydstream as depicted below. The International Chamber of Commerce (ICC) also plays a key role in this regard with its market intelligence reports such as the ICC Trade Register who collects, consolidates and aggregates transaction-level insights from the world’s largest financial institutions.

Acting as a generic data management layer, Intix provides increased transaction data accessibility to internal teams, and also feeds 3rd party machine learning processes. The same data capture technology can be applied across payments, fx, trade finance transaction data and all related events (e.g., sanctions screening, archiving, booking).

Interested in reading more on this topic?

- Fintechs collaborating: Coriolis Technologies and Intix combine their capabilities as “the future of trade is data”

- Fintechs collaborating: data technology and machine learning help originators upgrade trade operations and reduce cash conversion cycle

- Fintechs collaborating: data technology and machine learning help originators upgrade credit scoring and increase SME financing

- Automating your data feeds to the ICC Trade Register