‘Richly Deserved’ – Rabobank and Nordea discuss the role of payment transaction data with Intix

Fintech Finance asked Suzan van Eeten, area lead for payments at Rabobank, Tino Kam, Nordea’s head of product management transaction banking, and André Casterman, chief marketing officer at Intix, what they see as being the greatest opportunities and challenges in payments data.

The growing pace of open banking in Europe and beyond, customer expectations of instant everything, improved visibility of data that’s been siloed for years, and an explosion in digitisation forced by remote working, have pushed the world of payment processing dramatically forward.

At the same time, richer messaging formats and better tracking of transaction information, including cross-border developments like SWIFT gpi, the Nordics’ P27 payments system and the global adoption of ISO 20022, have put the pressure on providers new and old to get a grip on the information they hold.

Suzan van Eeten: With 12 million transactions a day, Rabobank needs robotics and automation to gather data and analyse it for our clients. Everything is automated for reporting and compliance; we have no manual work. We split our system into microsystems, connecting and decoupling, using APIs, because we’re working with lots of people on data transparency and need different components to work in parallel.

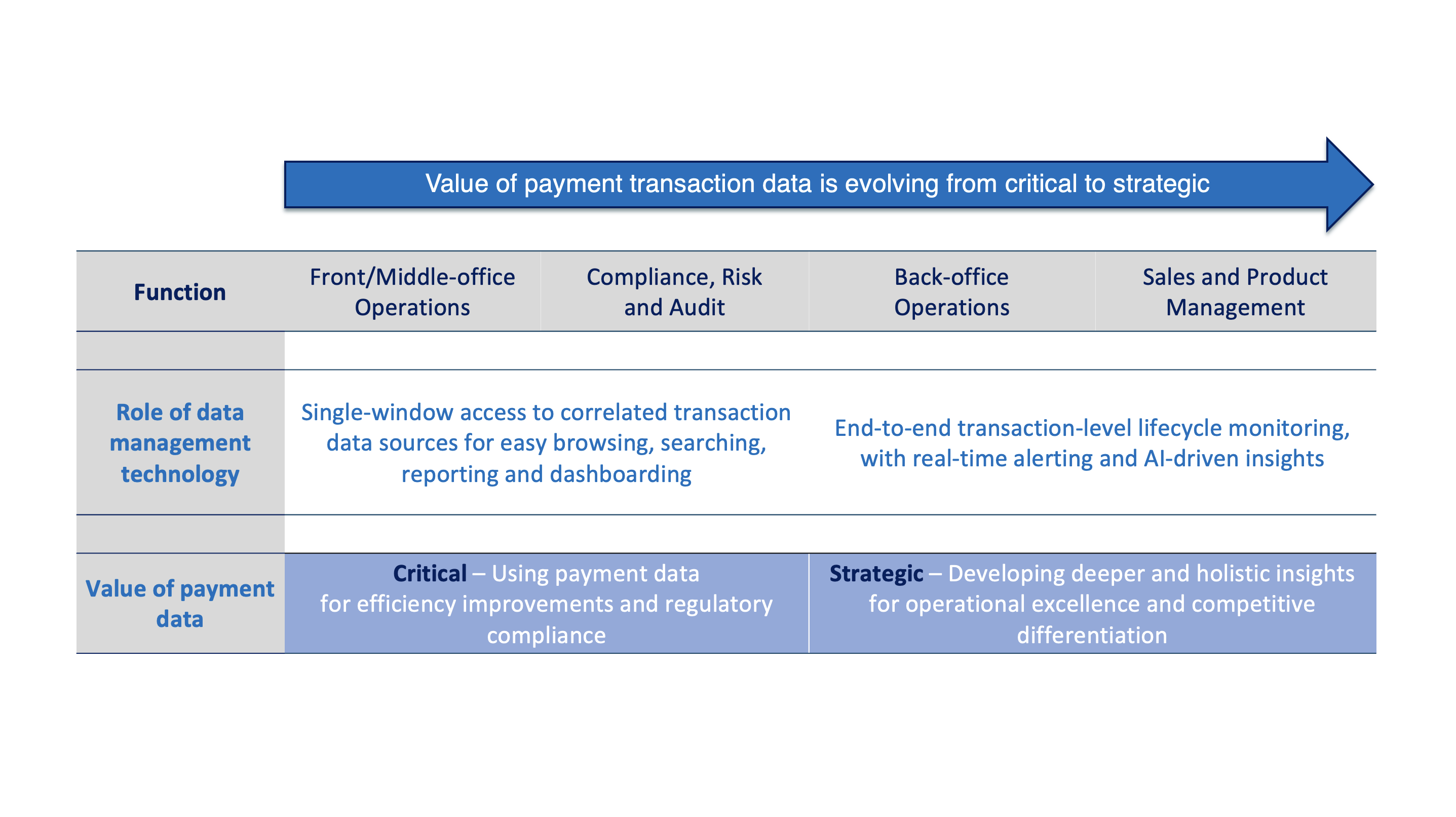

Tino Kam: Banks are exploring a number of those use cases, not least using the data to make sure we are even more secure and compliant from a payment perspective. Firstly, it can be used to make sure the infrastructure is secure and trusted. The second is related to what are we going to build on top of that infrastructure.

André Casterman: Getting access to their data internally, because it’s spread across so many systems, to associate different pieces of information and gain an understanding of a whole transaction. Banks have a lot of legacy systems and they need to change in line with new ways of working, like APIs, ISO 20022 and richer data, that are coming into the picture. New technologies are combining with older ones and, at Intix, we’re helping the banks get smooth, end-to-end access to that data, so that they can offer more value to their internal users and external clients.

Discover the Fintech Finance article here. Watch both debates: the Rabobank / Intix panel debate and the Nordea / Intix panel debate.