“Rewriting the payments story”

Issue 8 of “The PaytechMagazine” includes Fintech Finance’s interview of Standard Bank’s Sajid Gani, Head of Operations for CIB South Africa at Standard Bank. Sajid explains the importance for banks to look for the story in the data.

“Data always tells a story, if you look for the story”, says Sajid. “You have to analyse what the data is telling you, because this will reveal a story, and the most important story to look for is that of your client. What is that story in terms of operational efficiencies, or lack of them? And, consequently, how do you use these insights to make an informed decision that will help you better service your client?”

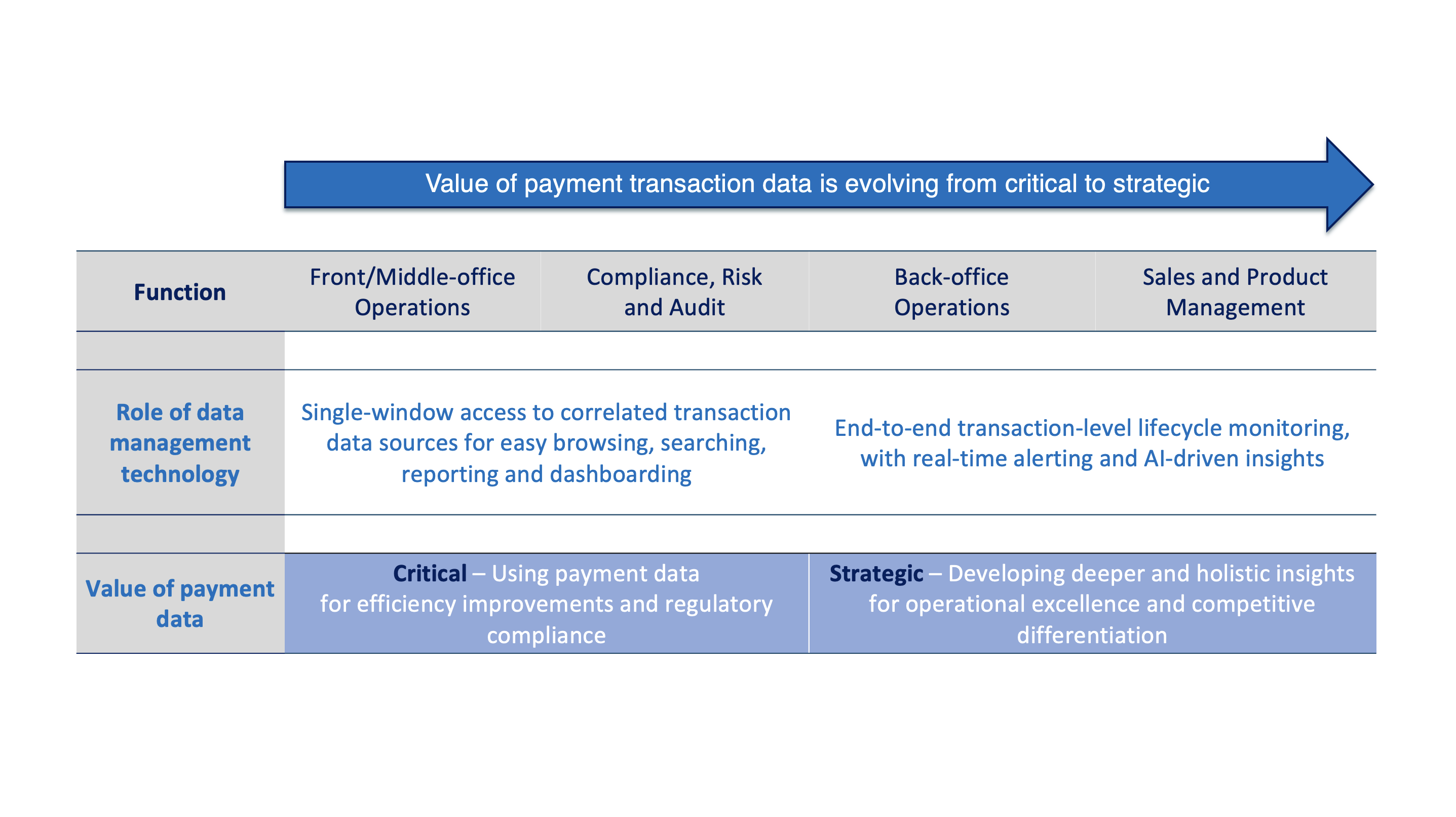

Take cross-border payments. They are a vital local income source, given Africa’s huge number of migrant workers wanting to send desperately-needed funds home quickly to their families. Products such as SWIFT gpi are already doing a good job of introducing transparency between correspondent banks. But when a payment enters a large institution that’s where the SWIFT tracking ends. The data insight team at technology company Intix has helped Standard Bank run a comprehensive tracking and tracing service from the moment transactions hit its internal processing.

“Once we have a glass pipe in place, the client should then be able to get full visibility and transparency of their payments”, says Gani. “Together SWIFT gpi and Intix provide end-to-end visibility and transparency and, in this regards, I think the partnership that we have with Intix is absolutely vital”.

Discover Sajid Ghani’s full insight here.