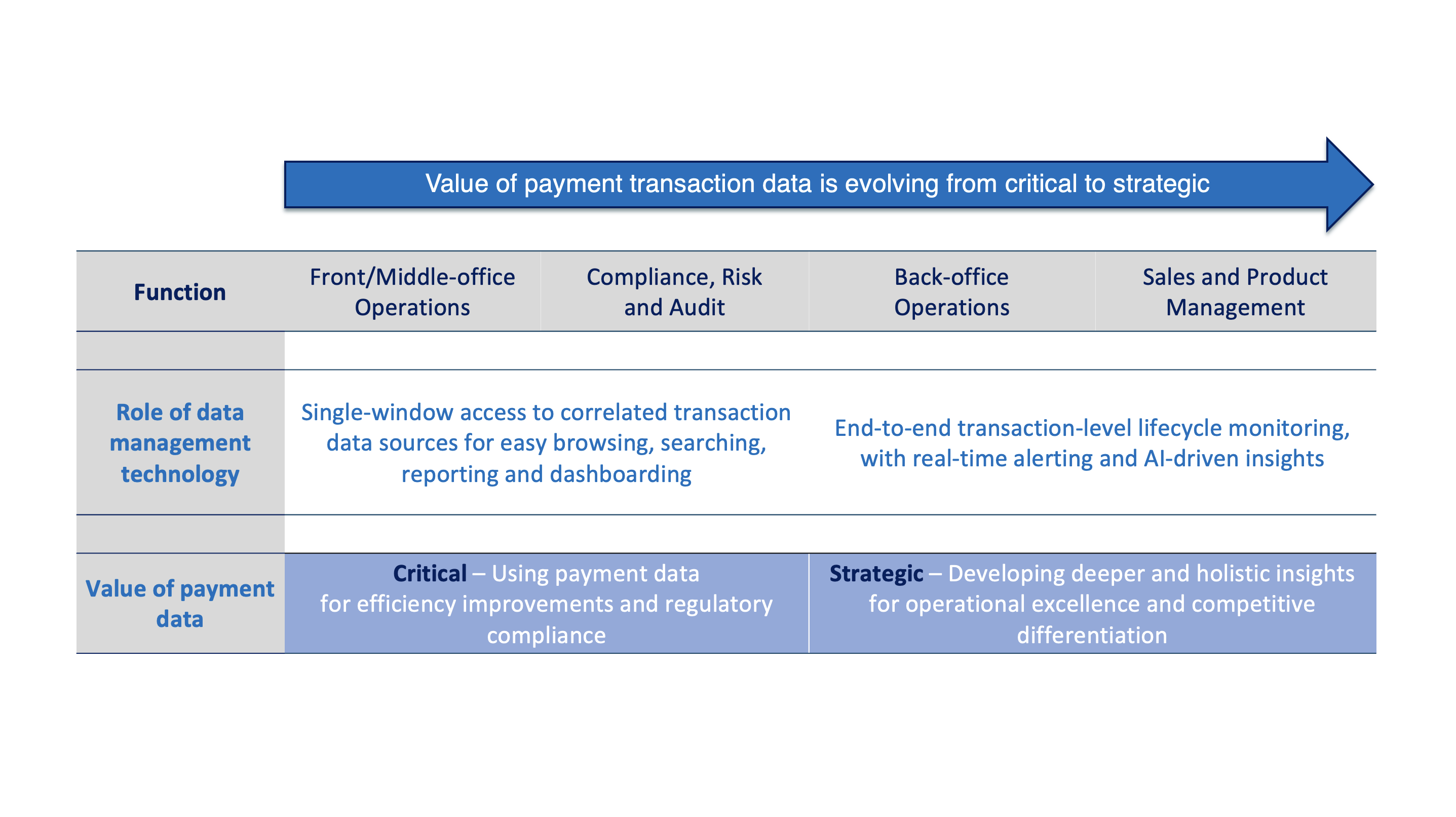

Focus on user experience through instant access to data

Fintech Finance talked to Eric Bayle, Head of Global Transaction Banking UK, Societe Generale about the importance of user experience and new technologies to make it happen.

Here are Eric Bayle‘s key messages:

- “Instant, frictionless, end-to-end account-to-account transactions anywhere in the world” is the key message that was highlighted at Sibos

- Corporate treasurers expect similar customer experiences as what they enjoy as consumers when using f.i. their banking app

- User experience, traceability, security and predictability are the main expectations from bank clients – also key for PSPs and third party providers

- New technologies include APIs, AI, machine learning, blockchain, DLT and, of course, use of data

- Tracking payments is essential, and this is a major development for banks in terms of client service – swiftGPI makes it happen between banks whilst Intix makes it happen within the banks

- The involvement of large card players such as Mastercard and Visa will bring new options for banks to process cross-border payments

- Regulation and AML screening is a major challenge for banks and this is repeated at each bank involved in the end-to-en correspondent banking processing

- The ISO 20022 standards will further increase interoperability

- The key element is customer experience both on the retail and wholesale sides. Also banks realise that they are not software companies. Today banks show more and more openness to third parties that are software companies. That’s what we did with Intix for increasing access to financial messaging data. Thanks to Intix, we can handle client queries instantly as we have instant access to 10 years of financial messaging data.

Discover the full interview below.