Intix helps banks mitigate new transparency risks in cross-border payments

Transparency in payment processing introduces new risks – Are you protecting your reputation?

Cross-border payments are becoming increasingly transparent. There is no doubt that slow and opaque inter-bank processes are becoming unacceptable in an increasingly digital and real-time economy. Incumbent messaging and payment processing platforms are tackling this issue fiercely by enhancing global payment practices. New norms are being established in order to address key hurdles in terms of processing speed, cost and transparency thereof. As a consequence, client expectations are rising, and competition between cross-border payment platforms intensifies. For many banks, this transformation of the cross-border payments market has another facet as it not only requires major investments but also introduces new risks.

The new transparency risks for banks involved in cross-border payments

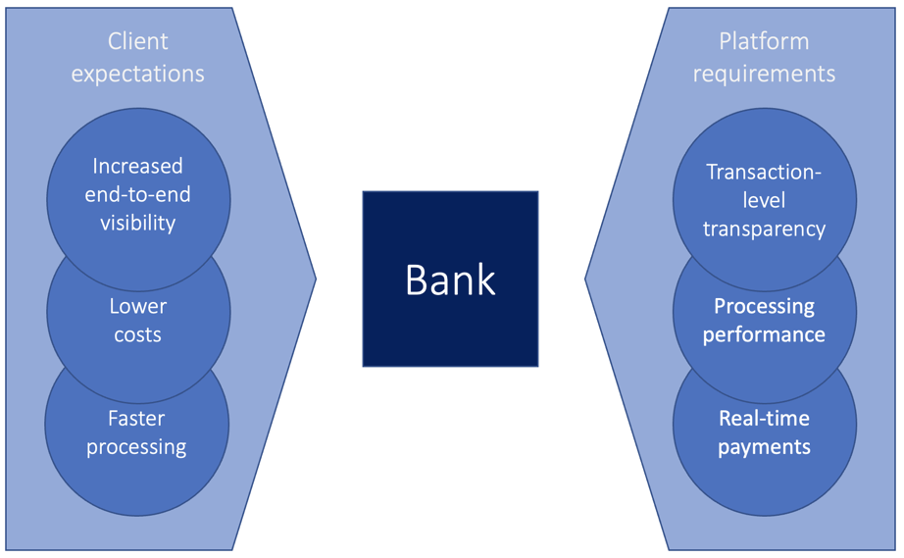

Whether processing cross-border payments via traditional correspondent banking or via new channels, banks are being put to the test as they need to keep up with evolving practices and new client expectations. Client expectations relate to (1) increased visibility of the end-to-end transaction processing, (2) lower costs and (3) faster processing to credit the beneficiary’s account. Similarly, various platforms are introducing more stringent service levels around (1) end-to-end transaction-level transparency, (2) processing performance and (3) support for real-time payments.

As highlighted in the below chart, banks are squeezed between several forces, and have no choice but to act in order to remain attractive in a more competitive environment:

The following risks emerge as the global payments market becomes far more transparent:

- Reputational risk. There is no doubt that the above changes help move the needle. Correspondent banking, as an example, has not improved since its migration away from telex that started in the mid seventies. Innovations such as SWIFT gpi, and also the Nordic P27 and the upcoming CBDCs require important infrastructure investments by banks. They also carry new risks for banks: for instance, failing to adhere to newly defined practices such as those introduced by SWIFT gpi can severely impact banks’ reputation as operational failures quickly become visible to correspondent banks.

- Scoring risk. As platforms introduce more stringent requirements, they also monitor the end-to-end lifecycle of payments they operate, make it as transparent (e.g., a shared ledger, SWIFT gpi Tracker) and sometimes police the proper adherence to their service levels by scoring users. By doing so, platforms transform themselves into global transaction-level watchdogs. This is a natural evolution: by monitoring individual payments across each and every intermediary bank, platforms gain valuable insights into banks’ own processing performance. Poor performance quickly transforms into red signals on central monitoring dashboards. Those analytics can quickly transform into scorecards which can negatively impact a bank’s competitive position in the market.

Enhanced transparency in cross-border payments exposes banks’ operational efficiency towards counterparties (e.g., being flagged as strong or poor performer in the end-to-end correspondent banking chain). There is a need to mitigate those risks, and technology can help here too.

Intix helps banks address new transparency risks in cross-border payments

Key questions emerge for banks involved in cross-border payments:

- Are we sufficiently monitoring our adherence to new client needs and operational platform requirements?

- Do we measure internal payment processing at transaction level?

- Do we mitigate the risks related to operational outages at transaction level? Do we know easily which transactions have failed if / when an outage occurs?

- Do we get instant alerts in case some value is at risk? In case service levels are at risk?

- Are we sufficiently protecting our reputation in cross-border payments? How can we remain an attractive player in correspondent banking and global payments?

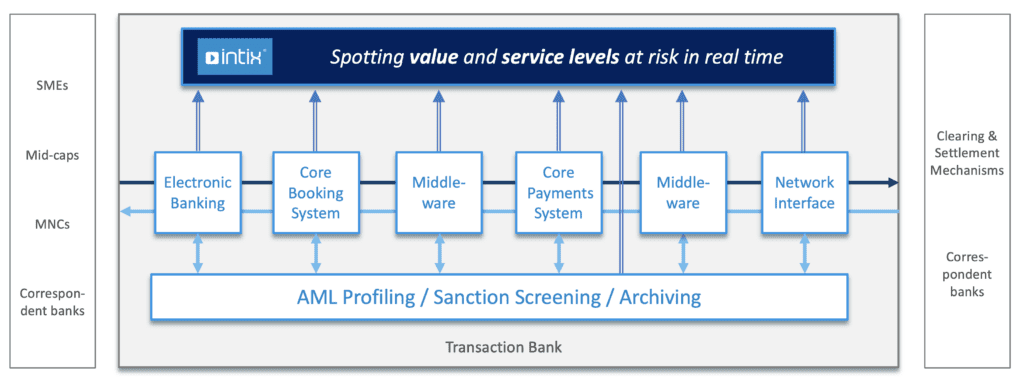

Intix helps banks mitigate those risks as two levels:

- Value at risk. By monitoring internal payment processing, Intix spots operational events affecting end-to-end internal payment flows. Any value at risk is reported immediately to the operations teams, and resolution can be actioned immediately.

- Service levels at risk. By tracking each and every payment transaction and related events, Intix spots operational incidents (as defined with configuration) and reports service levels (f.i. as defined by 3rd party platforms) at risk by pushing alerts to the appropriate teams.

The real-time monitoring of internal payment flows enables banks to become much more reactive to any transaction-specific incident across the end-to-end processing chain as depicted below.

Conclusion

Intix provides banks involved in cross-border payments a risk mitigation tool. The earlier any hiccup is spotted, the faster it can be resolved, and this is what Intix excels at. This helps avoid any ripple effect as operational hiccups can be fixed before they need to be reported to central watchdogs. This limits impacts onto customers and visibility towards counter parties.

Real-time monitoring and alerting of payment processing helps banks mitigate the risks involved in processing increasingly transparent cross-border payments. Whether payments get processed through the one or the other platform, Intix offers banks an advanced risk mitigation tool and helps them protect their reputation in the global payments industry.

What our clients are saying about Intix

Eric Bayle, Head of Transaction Banking UK, Société Générale: “Tracking payments is essential, and this is a major development for banks in terms of client service – swiftGPI makes it happen between banks whilst Intix makes it happen within banks.”

Erik Zingmark, Head of Transaction Banking, Nordea: “Nordea strives to come to a point where we will be able to monitor in real time where the payment is both within Nordea and outside Nordea. This is the goal of the business activity monitoring (BAM) project which brings that real-time information to our customers. BAM will help us also manage incidents more proactively. Intix brings us end-to-end transparency which is a must these days to serve clients.”

Sajid Gani, Head of CIB Operations South Africa, Standard Bank: “Various providers and new entrants are offering such low-cost instant payments at cross-border level. The heat is on for traditional banks which is why they need to move on from legacy thinking. Intix helps us understand the value at risk – we need the ability to understand at any time what the value at risk is across our internal payment value chain. Certain banks have this ability to quickly gain insights to resolve consequences of outages. This is a major competitive advantage. We also use Intix in conjunction with additional tools such as SWIFTgpi to extend the transparency to our clients.”

Find out how leading institutions take advantage of Intix on www.intix/xperience.