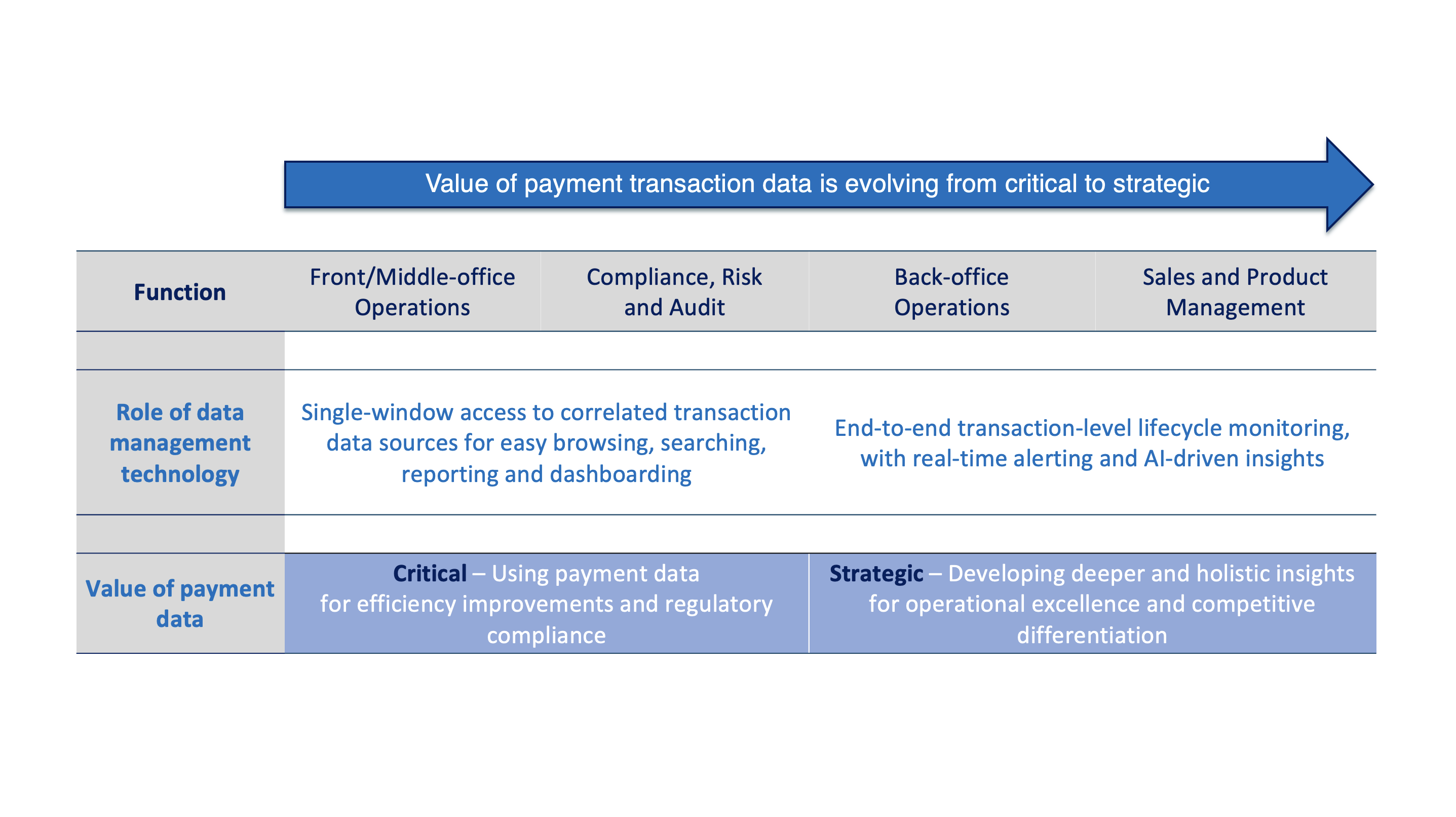

Make your payment transaction data actionable in real time

As the cross-border payment space is witnessing a flurry of new entrants, one value proposition stands out for all transaction banks: to track all types of cross-border payments across the ever expanding set of cross-border messaging, clearing and settlement networks.

As McKinsey pointed out in an October 2018 article: “Today, the global cross-border payment landscape is at the center of a number of trends that could fundamentally change competitive dynamics: increasing pressure from emerging technologies (including distributed ledger technology and card and network innovations); shifting regulatory and sanctions frameworks; accelerating international commerce (retail as well as corporate); and, especially, changing customer demands. In addition, firms new to the cross-border market are increasing competitive pressure on incumbents.”.

The global consultancy company concluded: “Alternative solutions and new competitors are upending the industry’s fundamentals.”

Fact is cross-border payments was once a space dominated by a single network provider known as SWIFT which succeeded to automate the electronic transmission of financial instructions, and, in particular, cross-border payments handled through correspondent banking relationships. Correspondent banking has been the de facto standard for clearing cross-border payments for decades, building on national clearing and settlement systems.

However, over recent years, alternative messaging, clearing and networking channels have emerged primarily focused on low-value retail and wholesale payments. Examples include Earthport (a global payments network) and EBICS (a secure Internet messaging protocol). Next to alternative networking options, new payment instruments such as real-time payments have been rolled out in dozens of countries, as well as in the pan-European market (SEPA). Those innovations have demonstrated that cross-border payments are being re-invented, and that clients are raising expectations.

Given the superior experience that real-time payments offer, this payment instrument is now expected to expand rapidly at cross-border level too. New entrants are indeed betting big on the “distributed ledger technology” (DLT) and on the blockchain to accelerate messaging, clearing and settlement of remittance payments in support of incumbent transaction banks and emerging payments processors. Examples of blockchain-based cross-border payment networks include Ripple and IBM.

Overtime, we should also expect the number of cross-border payments networks to specialise further. In addition, we should expect new currencies such as crypto assets to prove their relevance and find niche roles next to government-backed currencies. Examples include XRP and Stellar which are embedded in Ripple’s and IBM’s propositions respectively.

Considering the intense competition between traditional payment networks, as well as the emerging competition amongst recently established blockchain-based players, one can expect financial institutions to have ample choice and to gradually adopt those new options in order to improve service and experience to their clients. This however will drastically raise the level of complexity for banks’ internal payments operations teams.

Thai Siam Commercial Bank completes cross-border transfer using Ripple technology in just 1 minute. FXStreet

IBM signs 6 banks to issue stablecoins and use Stellar’s XLM cryptocurrency. Coindesk

As the number of network propositions expands, financial institutions will need holistic visibility on and tracking of all cross-border payments across networks – this is where Intix will help as a multi-network transaction warehouse supporting both traditional and emerging payments channels as well as fiat and cryptocurrencies. This is depicted below:

The main benefit of such specialised transaction-centric data technology and platform will be to handle the archiving, measurement, reporting, retrieval and tracking/alerting of all types of payments in a way that is independent from the underlying messaging, clearing and settlement processes.