- Compliance Operations

- Contextual Monitoring

- Data Accessibility

- Deep Insights

- Forensic Investigations

Leadership in data management – increasing efficiency in compliance investigations

We talked with Nezar Nassr, Product Manager at Intix to discuss the data management challenges faced by compliance officers in dealing with investigations, and the recent launch of xCOMPLY.

What is Intix all about?

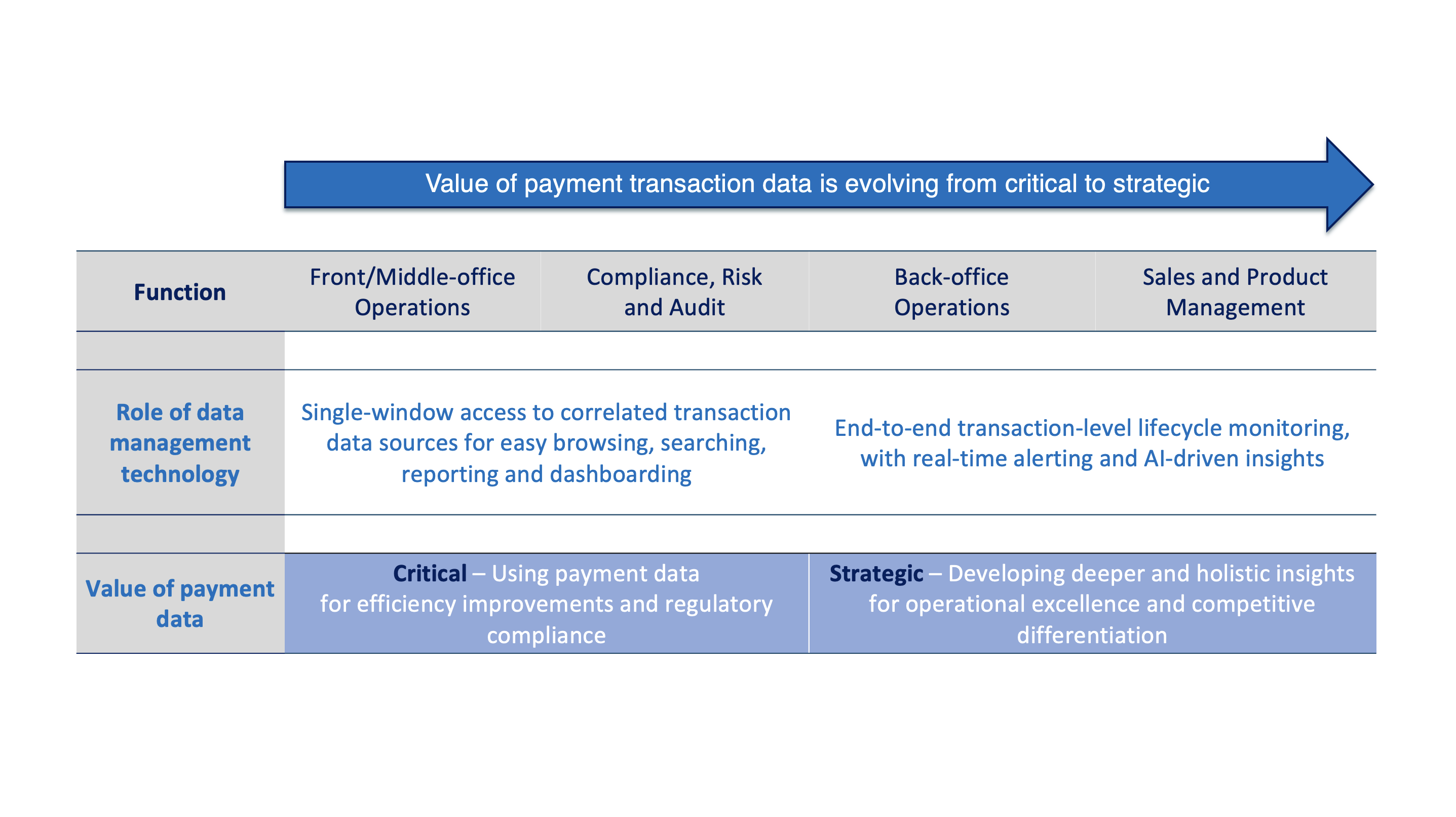

Nezar Nassr: Financial institutions need to get their data in order – this is obvious since years, but it also takes years to make it happen. Complexity is coming from the web of internal systems involved in processing transactions such as payments and securities. Trailing and tracing transactions across the various systems, technologies, middleware, databases, … requires deep technical and business expertise in financial messaging.

Intix has focused on this issue since a decade and has succeeded to help global and regional banks get their data in order by making transaction data more accessible and actionable. This is helping mainly operations and compliance teams which are highly intensive users of transaction details in their daily activities. Similar to search engine such as Google, Intix indexes transactions and runs queries on the indexes to avoid adding such load on production systems. It allows our clients to “make transaction data actionable in real time” which is our motto.

What is the purpose of xCOMPLY?

Nezar Nassr: xCOMPLY is all about knowing much more about your transactions. This means getting additional data from master data, processing systems, analysis, and archiving systems to understand the business context of transactions and get a holistic view. Every piece of data counts when investigating a transaction for compliance and fraud. Context-based analysis has proven to be very efficient, and it better be automated which is what xCOMPLY achieves.

When regulators are investigating specific firms, individuals, or transactions, they require banks to promptly provide them with details around the transaction. Those details are not always included in the transaction data and must be retrieved from other data sources. This is where xCOMPLY makes the difference as it will go and pull related data sets from different data sources to construct the holistic picture.

xCOMPLY automatically indexes and links all payment transaction data sourced from various systems, and this eliminates all the challenges involved in finding and accessing data as end-users benefit from a single window and correlated data sets. It then provides users with a full, thorough picture of every payment transaction from origin to processing completion. This facilitates accurate analysis and record-keeping and ensures that the FIs can respond quickly to regulators’ Requests for Information (RFIs).

What are the use cases for xCOMPLY?

Nezar Nassr: xCOMPLY is about correlating much more data to run compliance operations. It is also supporting record keeping requirements and feeding third-party systems such as AI engines, AML engines and case managers.

The top use cases include processing of Suspicious Transaction Reports (STR) and Suspicious Activity Reports (SAR) to respond to RFIs. New proposals in Europe now aim to allow FIs only five days or, in some cases, just 24 hours to respond to an RFI in comparison to 30 days previously. Norway is looking for swift and complete replies and FIs need to be prepared by putting a system in place that enables them to respond in just one day.

What’s the return on investment?

Nezar Nassr: Financial institutions need to ensure solid compliance in their reporting and be able to respond to regulators’ Requests for Information (RFIs) to avoid being fined, particularly in relation to payments data.

Beyond being slapped with a fine, any event of non-compliance also brings the risk of reputational damage, which can result in the FI being blocked out of correspondent banking relationships. There may also be reputational damage with its large corporate clients.

xCOMPLY significantly reduces manual intervention to retrieve transaction details and correlating with all related data. It means that financial institutions’ compliance teams spend less time collecting data and are equipped to not miss any of the data required. It also means that an investigation into a transaction can be completed promptly, ensuring that a financial institution maintains its reputation and avoids non-compliance fines.

What’s your advice to transaction banks?

Nezar Nassr: There is no escape to knowing your transactions thoroughly: you ought to get a 360-degree view on payments and their business origin and context to comply with regulatory requirements.

More information

Access the xCOMPLY product page for more information and read more about the recent product launch. Reach out to our team via our Contact page.