Compliance officers: put your data to work

When it comes to spotting fraudulent transactions, compliance officers face various challenges. One of those is very technical: how to access the data of all transactions processed by their own institution? Another one is very challenging: how to be alerted of any potentially fraudulent activity during processing? Technology can help. On-demand access to transaction data as well as continuous transaction surveillance can now be offered to compliance officers so they can do their job as efficiently as possible.

Fraud cases continue to make headlines and financial institutions are not refraining investments in risk mitigation solutions. Compliance officers in particular have huge needs for automated fraud prevention checks and for access to transaction data at enterprise level.

In this article, we expand on two use cases that are of particular importance for compliance officers active in transaction banking. Whether focusing on payments, fx, securities, trade finance, … needs are very similar when it comes to monitoring the integrity of end-to-end transaction flows (use case 1) and getting instant access to full transaction details (use case 2).

Use case 1 – Real-time transaction flow integrity surveillance

Following recent fraudulent events within both commercial and central banks, the security risks associated with collusion fraud are resulting in substantial damages, and are identified as more difficult to detect than other security breaches.

On collusion fraud – Employee collusion is posing threats to businesses including financial institutions because it involves larger damages and is more difficult to detect than other security breaches. When more employees are involved there are more opportunities to commit fraud and it is easier to circumvent anti-fraud controls and conceal the fraud longer.

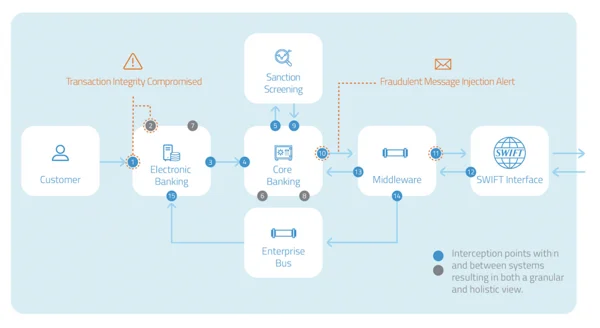

Problem statement – Transaction processing occurs across a variety of internal systems. Those include the e-banking and mobile banking platforms, front-end applications, middleware, sanctions filtering systems, core banking systems and finally the network or clearing system interfaces (e.g., RTGS, ACH, SWIFT). Recent fraud cases revealed huge financial and reputational risks of internal fraudulent activities such as falsification of payment instructions, self-authorisation of instructions through collusion and injection of fraudulent messages in the processing workflows.

Intix solution –Intix tracks, via configurable interception points, each step of the transaction processing chain on a real-time basis. Using this input, Intix raises alerts when identifying any alteration in transaction details occurring within and between systems. This helps detect any change of content which may arise from fraudulent activities. By doing so, Intix helps its clients to protect themselves against any tampering and any injection of unwarranted instructions in the internal processing chain. Intix technology enables such protection measures in real time and notifications are raised with no delay.

The benefits are immediate and strategic: reputational risk is mitigated as breach and collusion activities are spotted immediately which is also in line with regulators’ demands towards transaction banks.

Use case 2 – Instant access to all transaction data

As regulatory scrutiny on financial institutions increased drastically during the last decade, the pressure on regulatory compliance officers increased considerably. One of the main obstacles in this function is related to data accessibility which is often depleted due to legacy technology or due to dependency on other departments.

Problem statement – Financial institutions are under immense regulatory pressure to analyse transactional flows and spot suspicious activity. This is why compliance officers are continuously scrutinising transactions. To achieve this, they require access to all transaction details. However, they often face technical and operational challenges transactions are processed by a multitude of internal systems and transaction data is not centralised in a single system. As manual aggregation of transaction details often leads to delays and is prone to errors, it has become vital for compliance officers to get easy single-window access to all the required original transaction data by connecting to all internal systems.

Intix solution – The Intix data management technology helps them access original transaction details from long-term archives and from production systems, whilst recognising all past and current financial messaging formats. Searching as well as ad-hoc reporting and dash-boarding is instantaneous and allows for easy navigation through huge data sets. Intix integrates seamlessly with legacy systems and minimises technical integration whilst guaranteeing data integrity. With Intix, financial institutions increase their level of responsiveness as all needed data sources become available at their fingertips.

The benefits are immediate here as well in terms of operational excellence through the instant access to archived and production transactions. Also regulators’ ad-hoc enquiries on specific transaction sets can be handled promptly.

The Intix technology

The Intix technology integrates seamlessly with legacy data sources and quickly adapts to evolving requirements through configuration parameters. Key attributes are:

- Non-intrusive technology

- Standard software product

- Industry expertise

- Highly configurable

- Highly scalable

- Support for any message format