Evolution of cross-border payments piles pressure on banks

Developments in sector are beneficial but bring risks too, says Intix CMO.

Banks are under increasing pressure to keep up with technology in the cross-border payments space and risk suffering reputational damage if they are found to be the laggards in the payment process, says Intix chief marketing officer, André Casterman.

“Increased transparency in the cross-border payments process through initiatives like Swift GPI is putting pressure on banks to keep up because they need to be able to process payments faster and offer additional notifications to tell Swift where the payment is in their own processing,” Casterman says.

“Banks that are not able to keep up are going to lose out,” he says.

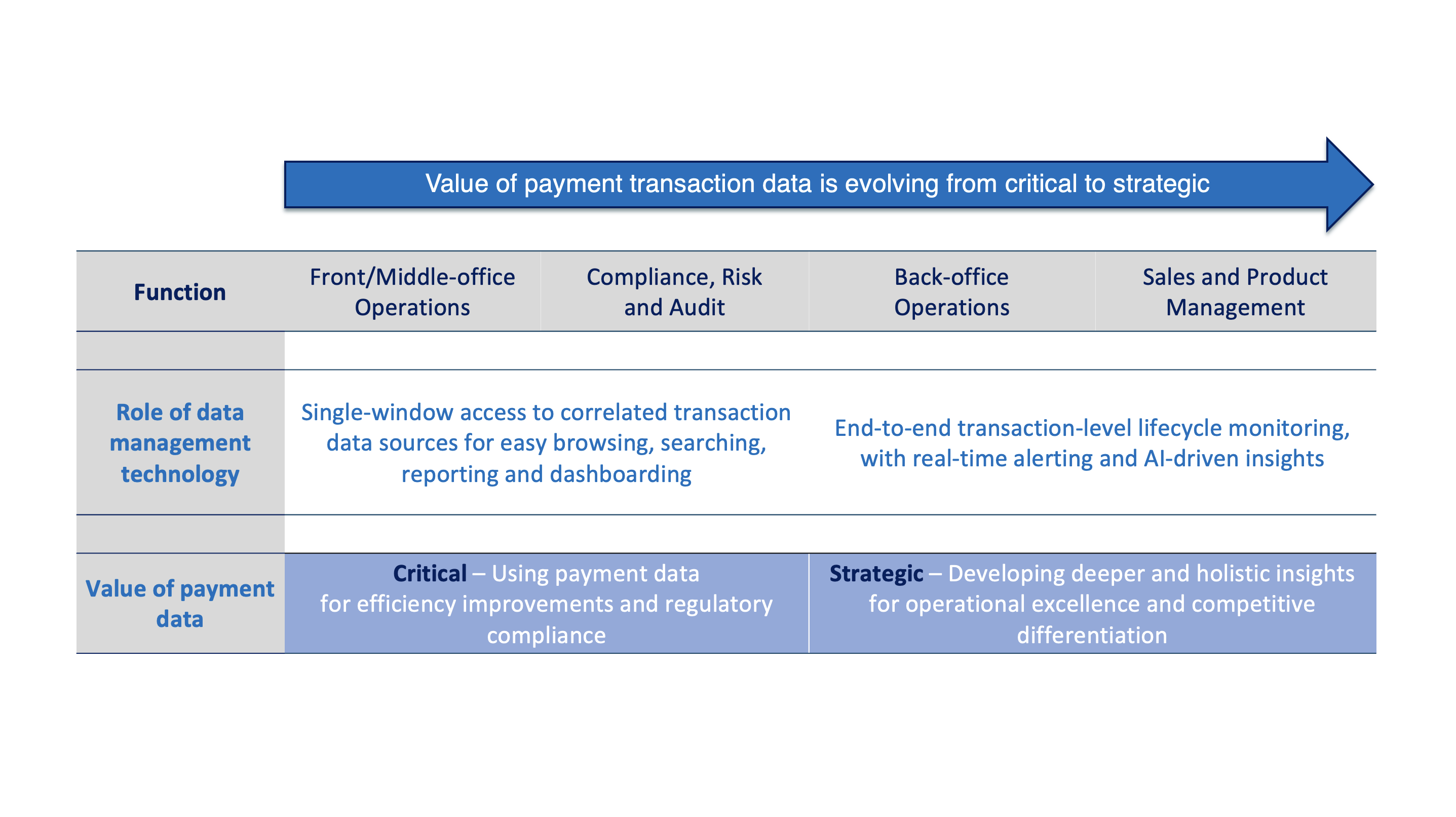

If you’re not aware of a problem within your own transaction processing chain, you can’t solve it, says Casterman. This is the crucial problem that Intix looks to solve for banks, providing a monitoring solution at both the transactional and individual level so banks can respond to cross-border payment challenges before they get out of hand.

“Knowing there is an issue is 50 percent of the solution,” says Casterman. “If there is an issue, you can promptly react and know exactly, thanks to technologies like Intix, which transactions are either at risk of failing the service level or have already failed. You can therefore size the team required to address those issues.”

Casterman adds that the pressure on banks will only increase at the move towards real-time cross-border payments soon becomes the norm. And with real-time payments, the need for continuous monitoring systems in turn becomes more apparent as response time must speed up.

Discover the full bobsguide interview here.