Leadership in transaction data management technology – the view from the Intix CTO

We talked to Wouter Van Santvliet, co-founder and CTO of Intix about data management technology, and how continuous technology enhancements are brought to financial institutions to address surging transaction volumes and new use cases.

You position Intix as a data management product company. What do you mean with data management when we hear so much about big data?

Wouter: “Intix powers financial institutions transaction banking operations with a standard software product that makes financial messaging data far more actionable than it usually is. This is why we are a product company. We equip our clients with advanced technology to capture transaction data from internal systems as this is the prerequisite to make it accessible and actionable. We are experts in this area across a myriad of database technologies, middleware products, APIs, messaging formats, semantic variations, … this is what we mean with data management. This process can also feed big data algorithms for further analysis and processing.”

You insist on making transaction data accessible. Are financial institutions really struggling to get access to the data they handle?

Wouter: “Making financial messaging data accessible represents a major technical and operational challenge for financial institutions given the complexity of internal operations and the variety of database technologies in place, as well as the changing formatting specifications. At Intix, we sort it out in a highly efficient way as we provide off-the-shelf plug-in’s to industry-standard messaging formats and interfaces such as Alliance Access, SWIFT’s flagship network interface. Once the data becomes accessible through Intix, we add value through f.i. transaction-level tracking and alerting. We can also deliver the data to 3rd party processes such as banks’ own portals and regulatory reporting applications.”

You claim implementation time is very short. How long does it take to implement Intix at a new client?

Wouter: “Implementation time really depends on the use case and the amount of analysis and configuration work required. Typically, an off-the-shelf implementation around SWIFT messaging can be deployed as quickly as within 4-6 weeks whilst a transaction tracking and integrity surveillance project would require around 4 months for the initial phase to move to production. We always recommend our new clients to phase projects with intermediate deliveries. This way, we enable clients to also refine their user requirements.”

You highlight the Intix solution as non-intrusive. How can Intix address so many different bank requirements with a standard software product whilst avoiding intrusiveness?

Wouter: “From day one, the Intix solution has been designed to support any kind of financial messaging specifications. This is why most of the client-specific work is related to analysis and configuration of the bank specific needs, rather than development. The Intix solution will then operate based on this bank-specific configuration and will not impact internal systems, neither from an operational perspective, nor from a change perspective. This mix of standard product features and declarative configuration decreases costs and risks for our new customers, which results in faster delivery.”

What is special to the way you handle transaction data?

Wouter: “What is very important to understand is that we don’t replicate data to build a data lake. It seems that financial institutions have learned their lessons here and walked away from such projects. Our technical approach is similar to Internet search engines. We index financial messaging data, we keep a trail to the original message location and we add value to this indexed information such as linking messages, tracking end-to-end business transactions and alerting on rule-based content or events. This is all done in real time.”

Financial institutions handle large amounts of transactions – how does Intix keep up with surging volume requirements?

Wouter: “Financial institutions manage indeed an ever-increasing volume of transactions which are each generating various types of transaction-level events (e.g., screening, booking, clearing, confirmation, reporting). Intix embeds a distributed architecture which caters for horizontal scalability (i.e., adding capacity by adding more hardware), redundancy and failover (i.e., avoiding single points of failure) and high availability (i.e., reducing down-time for maintenance). This way, we can expand to new use cases where we are part of a business critical solution.”

Is Intix relying on open source capabilities?

Wouter: “Intix embeds some open source components. Open source initiatives have become a major technology provider, often outperforming commercial solutions. As such, smart assembly of carefully selected open source components can be an important accelerator in software development. By embracing open source technology, Intix is addressing long standing problems in the financial domain using new age technologies, inspired by those underpinning large scale e-commerce and social media platforms.”

What is Intix’ position with regards to new technologies such as blockchain and AI?

Wouter: “Our top clients are indeed implementing those new technologies. With regards to blockchain-based transactions whether in payments, trade or securities, we index those flows in the same way as we do today for traditional messaging flows exchanged over SWIFT, Ebics and e-banking. With regards to AI, we are collaborating with AI-focused vendors that are dependent on the accessibility of internal transaction data. The combination of data and AI is a winning formula and transaction data is clearly the fuel for AI to deliver the appropriate compliance and credit scoring insights.”

Which are the typical business areas that Intix serves today?

Wouter: “Most of our implementations are related to wholesale payments. We also have clients in commercial finance, trade finance and securities. It is often related to SWIFT messaging but not exclusively. Clearly the automated processes we facilitate are of interest to Operations and Compliance teams within financial institutions. We also serve IT functions (e.g., archiving, audit) and sales functions (e.g, client dashboards).”

What is Intix’ position with regards to innovations in domestic and cross-border payments such as SWIFTgpi, Mastercard, Visa, Ripple, …

Wouter: “We are channel-agnostic and embed those new technologies and communication options in our standard product based on client priorities. Clearly Intix embeds the MT and ISO 20022 standards as well as the Alliance interfaces in standard. We recently integrated SWIFTgpi too. We know our clients are implementing additional channels such as Ripple, Visa and Mastercard, and are fully aligned on the evolution of the market in this space. New channels and communities are arising faster than legacy is being decommissioned, and this world is becoming far more complex. It is precisely this complexity that enables Intix to provide added value. Financial institutions will find it very valuable to rely on Intix as the control tower across all those channels and counter-parties.”

What is the keyword phrase that best represents the value that Intix brings to financial institutions?

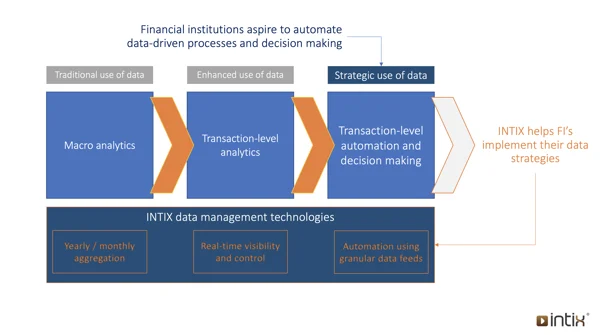

Wouter: “Value is created through automation. So that’s the key phrase that describes us best: automating your data-driven processes and decision making. It is critical to enable the automated generation of transaction reports, of enterprise-wide analytical dashboards, of transaction-level analytics and alerts, of transactional data feeds to various applications, … This is how we deliver real-time visibility and control on banking operations, serving both internal and external end-users.”

About Wouter Van Santvliet

Wouter Van Santvliet co-founded Intix in 2011 and has been the Chief Technology Officer since then. At Intix, Wouter is responsible for product management, operations and technology strategy and serves on the Intix Board. In 2002, Wouter co-founded and was CTO of Trax, a software development company providing payment factory and electronic banking solutions to large corporates and financial institutions. In 2006, Trax was acquired by Sungard (acquired by FIS since then).