Putting your transaction data to work – are you maximising operational and business agility?

The battle for cost efficiency and service differentiation in transaction banking has been going on for years, and it is only intensifying as we enter a more digital world following COVID-19.

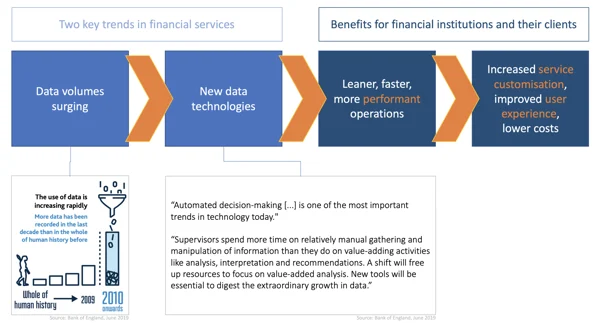

Over the last decade, we have witnessed two technology-related trends impacting most segments of the financial services industry: (1) the huge volumes of data being generated on a continuous basis as digital processing intensifies, and (2) new data technologies enabling high-volume real-time processing. This is opening up vast opportunities for financial institutions to deliver more customised services and an improved user experience, whilst lowering costs thanks to automated processes. Whereas much progress was achieved in the consumer space so far – driven by bigtechs and neo-banks – we see now more and more incumbent financial institutions aspiring to follow suit.

Defining and implementing a data strategy has become a top priority for all types of financial institutions ranging from retail, wholesale as well as private banks. Bankers’ mindset has shifted radically as most now recognise that implementing a data strategy is not about building failed “data lakes”.

“The use of data is increasing rapidly. More data has been recorded in the last decade than in the whole of human history before”, Bank of England June 2019

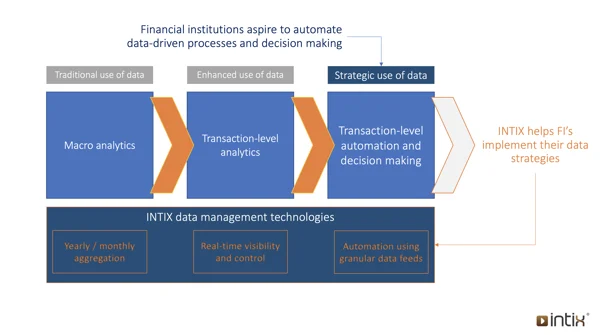

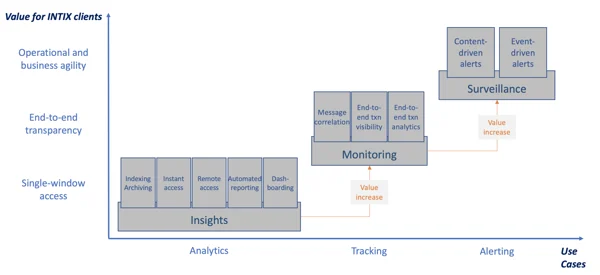

Whereas business intelligence statistical tools have been in use since the nineties, financial institutions now need to move well beyond the traditional use of analytics. The enhanced use of data means analytics are produced at transaction level aiming to achieve transaction-level automation and decision making. Goal is to reach the optimal level of agility by monitoring – in real time – all transaction-level events taking place in the internal processing chain. Such agility can serve both operational and business objectives. This is outlined below:

“Implementing a data strategy isn’t about building yet another [usually failed] data lake. Data technologies help automate transaction-level services to increase operational and business agility”, Intix

In order to achieve the above, FI’s are often confronted with the hard reality of complex and policy-driven IT environments where change is not welcome. The typical IT set-up makes access to data very burdensome given the numerous database and security technologies in place. This is where dedicated data management technologies – as those provided by Intix – fill the gap taking into account both technical and policy constraints.

“… vast quantities of data are being used to improve and personalise services … New technologies are […] providing more cost-effective, tailored and inclusive services.”, Bank of England, June 2019

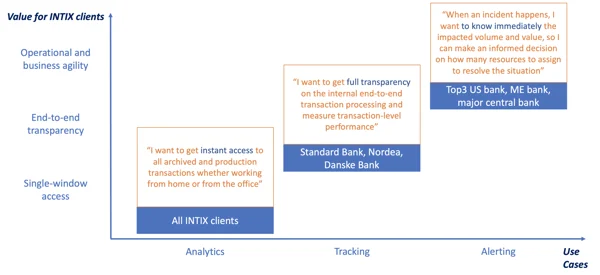

Once the needed data becomes accessible through Intix, financial institutions are equipped to benefit from single-window access to all their systems, from end-to-end processing transparency and become more agile based on transaction-level alerting. Typical feedback as reported by Intix clients are outlined below:

Intix guides financial institutions in their use of transaction data, and delivers off-the-shelf use cases such as those presented below. Those range from transaction-level analytics, to end-to-end tracking of internal processing to content / event-based surveillance:

Various types of financial institutions have understood the opportunity: