Intix “promised land’ in Deutsche Bank’s Flow magazine

Discover Intix CMO André Casterman’s recent contribution to Deutsche Bank’s Flow magazine.

While transaction data is now firmly established as a new economic asset, financial institutions are facing several challenges to monetise the vast amount of transaction information flowing through their systems. These need to be overcome, says André Casterman

Long considered an impenetrable space dominated by a few, the financial services industry now finds itself on a giant wave of entrepreneurial disruption, disintermediation and digital innovation.

Tightening regulation – along with the knock-on costs of implementation and emerging competition from nimble, non-bank new entrants – has rearranged the competitive landscape. However, one way in which financial institutions can defend their position is to contextualise their client offerings based on their view of the client transactional data that flows through their platforms.

As the McKinsey report Monetizing data, a new source of value in payments (September 2017)1 puts it, “Payments providers are in a uniquely powerful position to pursue emerging opportunities because they have insights into merchants as well as consumers, and can bridge the gap between them by providing incentives to influence consumers’ choice of merchants. But they also face challenges, such as how to operate successfully within data-privacy constraints and how to deal with disputes on data ownership. Finding solutions will require a thoughtful and gradual approach, starting with the data that is easiest to obtain and that shows promise for value.”

Data hunger

Transaction data, including transaction processing status and history, is now becoming the new gold mine for financial institutions because it:

- Tells where, when and how customers consume transaction services and how much revenue is derived from such activity;

- Exposes vital information across all of the moving parts of the financial institution (e.g., systems, processes, relationships, reciprocity); and

- helps improve customer engagement, optimise service delivery and increase service profitability.

In addition, clients expect continuous and real-time access to and traceability of their transactions, as well as on-demand support – the ease of personal banking via mobile phone apps sets corporate treasury solution expectations. Extraction of this “gold”, however, means providers need to have the technology to access the distinctive data sets and to know what analytics techniques to apply.

Commenting in IBS Journal at Sibos Toronto 2017, Deutsche Bank’s Head of Digital Cash Products and Americas Head of Cash Management, David Watson, said, “The data that we sit on concerning our clients’ businesses is the key. The products we develop should and will be based on data and not technology. Data is the future – both the data we have and what we do with it. Clients repeatedly tell me that they would pay for information based on what they have sent me. I’d rather they send me more data, and then let me work out how they can better farm that and use it to make decisions.”2

“Tightening regulation has rearranged the competitive landscape”

Regulatory catalyst

Regulation has actually been a catalyst here in helping financial institutions to see their data as something that should be managed as an asset. Unlike other assets, data can be endlessly reused and contribute to various algorithms. Using it for regulatory reporting does not deplete it for other uses.

Reporting requirements, such as those under BCBS 239, CRD IV Capital Requirements Regulation (CRR) and MiFID II Transaction Reporting, have rippled across asset classes, creating an immense pressure on financial institutions to aggregate transaction data across various systems. Regulators now require data management to be a foundational effort in all financial institutions for the purposes of risk management and compliance reporting.

For example, by introducing BCBS 239 ‘Principles for effective risk data aggregation and risk reporting’ in 2013,3 regulators got banks to make major improvements in risk data aggregation capabilities and risk reporting practices. Following this, banks have recognised the benefits of doing this. They see the improvements in terms of strengthening the capability and the status of the risk function to make judgements. This leads to gains in efficiency, reduced probability of losses, enhanced strategic decision-making and, ultimately, increased sustainability and profitability.

Technology layering

The archiving, reporting and screening obligations incumbent on those holding transactional data have made huge demands on capabilities and resource to search through and report transactions – whether these reside in long-term archives or within current systems. And all too often, implementations have been carried out at department or system level in the quest to get the job done, with the result that the wider picture of what that data really represents is obscured.

While financial institutions are now much more aware of the value locked into the vast amount of transaction data they hold, its extraction is easier said than done. Data management solutions designed specifically for the financial services industry help financial institutions adopt a focused approach. The path to monetisation involves tackling four basic challenges: accessibility, visibility, infrastructure and delivery.

- Accessibility. The data management technology solution must make it possible to connect hundreds of internal systems – seamlessly.

- Visibility. Financial messaging recognition must be embedded in the architecture so that the technology can handle both industry standards (such as ISO 20022, ISO 15022, FIX) and proprietary formats.

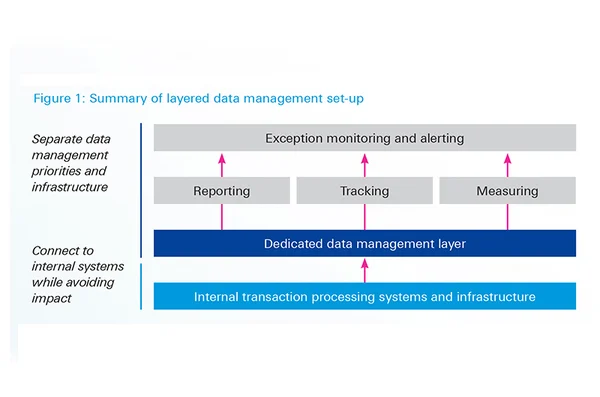

- Infrastructure. A dedicated high-performance data management layer is needed to address all reporting, tracking, measurement and exception alerting requirements (see Figure 1).

- Delivery. Implementation of and upgrades to a data management solution of this kind are to be prioritised, developed and rolled out independently from those applied to internal transaction processing systems. It is important to avoid the integration of “data” requirements within existing processing systems.

Acting as an enterprise-wide data management layer, such dedicated technology can be implemented by transaction banks across various strategic business areas, such as regulatory compliance, business intelligence and development, business activity monitoring, risk and audit metrics, and customer service.

Once the technology is in place, the opportunities to make transaction data available to clients, along with the financial institution’s analysis and interpretation, present themselves.

Financial institutions that are able to tackle data management challenges at infrastructure level will be able to draw a competitive advantage through enhanced strategic decision making, improved customer experience and effective risk management.

_________________________

Sources

1 McKinsey report, Monetizing data, a new source of value in payments. See http://bit.ly/2xOISXW at mckinsey.com

2 See http://bit.ly/2FRj6Gz at ibsintelligence.com

3 See http://bit.ly/2FYuYlV